Which Of The Following Is The Correct Accounting Equation

Juapaving

Mar 22, 2025 · 6 min read

Table of Contents

Which of the Following is the Correct Accounting Equation? Understanding the Fundamental Accounting Equation

The fundamental accounting equation is the bedrock of double-entry bookkeeping. It's a cornerstone concept that every accountant, bookkeeper, and aspiring finance professional must master. This equation ensures the balance sheet always balances, reflecting the financial health of a business. But which of the following equations is the correct one? Let's explore the fundamental equation, its components, and why some variations are incorrect.

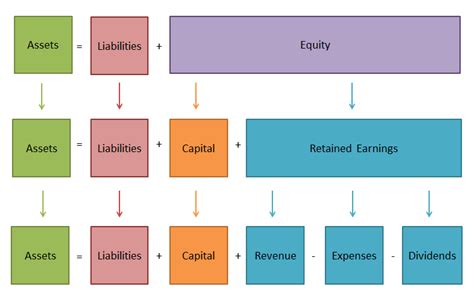

The Correct Accounting Equation: Assets = Liabilities + Equity

The correct fundamental accounting equation is:

Assets = Liabilities + Equity

This simple yet powerful equation represents the basic relationship between what a company owns (its assets), what it owes to others (its liabilities), and what belongs to the owners (its equity). Let's break down each component:

1. Assets

Assets are resources controlled by the company as a result of past events and from which future economic benefits are expected to flow to the entity. In simpler terms, these are things the company owns that have value. Examples of assets include:

- Current Assets: These are assets expected to be converted into cash or used up within one year. Examples include:

- Cash: Money on hand or in bank accounts.

- Accounts Receivable: Money owed to the company by customers.

- Inventory: Goods held for sale in the ordinary course of business.

- Prepaid Expenses: Expenses paid in advance, such as rent or insurance.

- Non-Current Assets: These are assets expected to provide benefits for more than one year. Examples include:

- Property, Plant, and Equipment (PP&E): Land, buildings, machinery, and equipment.

- Intangible Assets: Non-physical assets such as patents, copyrights, and trademarks.

- Long-term Investments: Investments in other companies or securities held for longer than one year.

2. Liabilities

Liabilities represent a company's obligations to outsiders. They are amounts owed to creditors or other parties. Examples of liabilities include:

- Current Liabilities: These are obligations due within one year. Examples include:

- Accounts Payable: Money owed to suppliers for goods or services.

- Salaries Payable: Wages owed to employees.

- Short-term Loans: Loans due within one year.

- Non-Current Liabilities: These are obligations due in more than one year. Examples include:

- Long-term Loans: Loans due in more than one year.

- Bonds Payable: Money raised by issuing bonds.

- Deferred Revenue: Money received for goods or services that haven't yet been delivered.

3. Equity

Equity represents the residual interest in the assets of the entity after deducting all its liabilities. It's the owners' stake in the company. For a sole proprietorship or partnership, equity is often referred to as owner's equity. For a corporation, it's called shareholder's equity. Key components of equity include:

- Contributed Capital: Money invested by the owners.

- Retained Earnings: Accumulated profits that have not been distributed to owners as dividends.

- Treasury Stock: Company's own stock that has been repurchased.

Why Other Equations Are Incorrect

While the fundamental accounting equation remains constant, some might present variations that appear similar but are fundamentally flawed. Understanding why these are incorrect is crucial for a firm grasp of accounting principles. Let's examine some common incorrect variations:

-

Assets + Liabilities = Equity: This equation is backward. Assets are what the company owns, and they are equal to the sum of what the company owes (liabilities) and what belongs to the owners (equity).

-

Liabilities = Assets + Equity: This again reverses the core relationship. Liabilities are part of the equation, not the whole thing.

-

Equity = Assets - Liabilities: While mathematically correct (derived from the fundamental equation), presenting this as the fundamental equation is misleading. It doesn't clearly represent the relationship between assets, liabilities, and equity as a whole. The fundamental equation stresses the balance, emphasizing that assets are always equal to the sum of liabilities and equity.

-

Assets = Liabilities - Equity: This is completely incorrect and violates the fundamental accounting equation. Assets are never less than the combined value of liabilities and equity.

Practical Applications of the Accounting Equation

The accounting equation is more than just a theoretical concept; it's a vital tool used in various accounting practices. Here are some of its practical applications:

-

Balance Sheet Preparation: The accounting equation serves as the framework for constructing a balance sheet. The balance sheet, a key financial statement, reports a company's assets, liabilities, and equity at a specific point in time. The equation ensures that the total assets always equal the sum of total liabilities and total equity, confirming the balance sheet's accuracy.

-

Analyzing Financial Health: The equation helps in analyzing a company's financial health. By examining the relationship between assets, liabilities, and equity, one can assess a company's solvency (ability to pay its debts), liquidity (ability to meet short-term obligations), and profitability (ability to generate profits). For example, a high level of debt (liabilities) relative to equity might signal financial risk.

-

Transaction Analysis: Every business transaction affects at least two accounts, maintaining the balance of the accounting equation. For instance, if a company purchases equipment with cash, both assets (equipment increases) and assets (cash decreases) are affected, keeping the equation balanced. Understanding this fundamental concept is essential for accurate bookkeeping.

-

Detecting Errors: Discrepancies in the accounting equation often indicate errors in recording transactions. If the equation doesn't balance, it signals the need for a thorough review of the accounting records to identify and rectify the errors.

-

Financial Forecasting: The accounting equation can also be used in financial forecasting. By projecting future changes in assets, liabilities, and equity, businesses can estimate their future financial position. This is valuable for planning purposes, such as securing loans or making investment decisions.

Advanced Considerations

While the fundamental accounting equation remains simple, its application can become more complex in advanced accounting scenarios. Factors like:

-

Shareholder's Equity: The complexity of equity increases significantly in corporations, involving aspects such as retained earnings, common stock, preferred stock, treasury stock, and accumulated other comprehensive income. Each transaction impacting equity requires careful consideration to ensure the equation stays balanced.

-

Adjusting Entries: At the end of an accounting period, adjusting entries are made to ensure revenue and expenses are accurately reflected. These entries affect both assets, liabilities, and/or equity, demanding precise application of the accounting equation to maintain accuracy.

-

Consolidated Financial Statements: When dealing with parent companies and subsidiaries, consolidated financial statements require the aggregation of assets, liabilities, and equity across multiple entities, making the application of the accounting equation more complex.

Conclusion

The fundamental accounting equation, Assets = Liabilities + Equity, is the cornerstone of accounting. Understanding its components, its practical applications, and the reasons why variations are incorrect is critical for anyone involved in finance or accounting. This equation underpins the accuracy and reliability of financial statements, providing a valuable tool for analyzing financial health, detecting errors, and forecasting future financial performance. Mastering the fundamental accounting equation is a foundational step towards a strong understanding of financial accounting principles. It serves as a constant reminder of the inherent balance within a company's financial structure and the interrelation between its resources, obligations, and owners' investments.

Latest Posts

Latest Posts

-

Are Wavelength And Energy Directly Proportional

Mar 22, 2025

-

What Can 63 Be Divided By

Mar 22, 2025

-

What Is The Fraction For 62 5

Mar 22, 2025

-

What Is Transitive Property Of Congruence

Mar 22, 2025

-

What Is The Formula Of Zinc Chloride

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is The Correct Accounting Equation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.