Which Of The Following Is Not A Transfer Payment

Juapaving

Mar 16, 2025 · 5 min read

Table of Contents

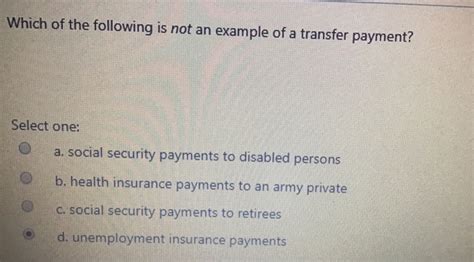

Which of the Following is Not a Transfer Payment? Understanding the Nuances of Government Spending

Transfer payments, a cornerstone of government fiscal policy, represent a significant portion of government spending. Understanding what constitutes a transfer payment, and more importantly, what doesn't, is crucial for grasping the complexities of public finance and economic policy. This article delves deep into the definition of transfer payments, explores various examples, and clarifies why certain government expenditures are excluded from this category.

Defining Transfer Payments: A Foundation for Understanding

A transfer payment is a payment made by the government to individuals or businesses for which the government receives no goods or services in return. It's a one-way flow of funds, designed to redistribute income or provide social support. The key characteristic is the absence of a quid pro quo; there's no direct exchange of goods or services for the payment.

This contrasts sharply with government purchases, which represent spending on goods and services that the government directly utilizes or consumes. Examples include salaries of government employees, construction of roads, and procurement of military equipment. These purchases contribute directly to the production of goods and services within the economy.

Examples of Transfer Payments: The Bread and Butter of Social Welfare

Numerous programs fall under the umbrella of transfer payments. Understanding these examples reinforces the core concept of no direct exchange for the funds received:

-

Social Security Benefits: Payments made to retired workers, disabled individuals, and survivors are classic examples. The recipient receives funds without providing any current goods or services in return to the government.

-

Unemployment Insurance: Payments to individuals who have lost their jobs. Again, the benefit is received without any concurrent contribution to the government's production of goods or services.

-

Welfare Payments (e.g., Temporary Assistance for Needy Families - TANF): These programs provide financial assistance to low-income families. No goods or services are exchanged for the payment.

-

Medicare and Medicaid: While these programs involve healthcare services, the payments themselves are considered transfers because the recipient does not directly provide goods or services to the government in exchange for the coverage. The healthcare providers are paid separately.

-

Subsidies (in specific contexts): Certain subsidies can be considered transfer payments. For example, a direct cash subsidy to farmers without a requirement for specific goods or services in return would qualify. However, subsidies linked to specific production targets or environmental measures often blur the lines and might not be purely transfer payments.

What is NOT a Transfer Payment? Identifying the Exceptions

To fully understand transfer payments, it's equally important to examine government expenditures that do not qualify. These expenditures involve a clear exchange of goods or services:

-

Government Purchases of Goods and Services: As mentioned earlier, spending on goods and services used by the government (salaries of government employees, military equipment, road construction, etc.) is not a transfer payment. The government receives a direct benefit in return for its spending.

-

Government Investments: Investments in infrastructure (roads, bridges, schools) or research and development are not transfer payments. These investments aim to enhance future productivity and economic growth, with the government receiving the benefit of improved infrastructure or technological advancements.

-

Government Grants with Strings Attached: Government grants awarded to businesses or individuals with specific conditions or requirements attached may not be purely transfer payments. If the grant requires the recipient to deliver specific goods or services (e.g., research outputs, job creation), the transaction involves an exchange, blurring the lines between transfer payment and government purchase.

-

Loan Repayments: While the initial disbursement of a loan may appear similar to a transfer payment, the subsequent repayment constitutes a return of funds to the government. Therefore, the entire process is not considered a pure transfer payment.

The Grey Areas: Where the Lines Blur

The distinction between transfer payments and other government expenditures can sometimes be blurry. Several scenarios present complexities:

-

Subsidies with Conditions: As noted earlier, subsidies can occupy a grey area. If a subsidy is tied to specific production targets, environmental improvements, or job creation, it partially resembles a government purchase, as the government receives certain benefits in return.

-

Education Spending: Government funding for education is complex. While some aspects might resemble transfer payments (e.g., scholarships), other aspects involve government purchases (e.g., teacher salaries). The distinction hinges on the specific nature of the expenditure.

-

Healthcare Spending (Beyond Medicare/Medicaid): Government funding for public health initiatives or disease prevention programs often fall into a grey area. The benefits to the government might be indirect (improved public health), making a precise classification challenging.

The Importance of Distinguishing Between Transfer Payments and Other Government Spending

Understanding the difference between transfer payments and government purchases is crucial for several reasons:

-

Economic Analysis: Transfer payments are excluded from the calculation of Gross Domestic Product (GDP) because they do not directly contribute to current production. Including them would inflate the GDP figure and misrepresent the true economic output of a nation.

-

Fiscal Policy Analysis: Transfer payments are a vital tool for fiscal policy. Governments utilize them to manage income inequality, stabilize the economy during recessions, and support vulnerable populations. Understanding their role is key to evaluating the effectiveness of fiscal policies.

-

Budgetary Analysis: Differentiating between transfer payments and other government spending is essential for analyzing government budgets and evaluating the allocation of public resources.

-

Public Policy Debates: Transfer payments are frequently at the center of public policy debates, including discussions on social welfare, income distribution, and the size and scope of government. A clear understanding of their nature is vital for informed participation in these discussions.

Conclusion: Navigating the Complexities of Government Finance

Transfer payments are a fundamental aspect of modern government finance, playing a pivotal role in social welfare and economic management. However, the definition is not always straightforward. Careful consideration of the nature of the transaction—whether or not there's a direct exchange of goods or services—is crucial for distinguishing transfer payments from other forms of government spending. By understanding these nuances, we can develop a more accurate and comprehensive understanding of how governments operate and the impact of their fiscal policies on the economy. This knowledge empowers citizens to participate more effectively in public policy debates and to hold their governments accountable for the effective and responsible use of public funds. The continued discussion and refinement of these definitions are essential to ensuring the transparency and effectiveness of government programs and policies.

Latest Posts

Latest Posts

-

How Many Symmetry Lines Does A Square Have

Mar 17, 2025

-

Do Viruses Belong To One Of The Domains Of Life

Mar 17, 2025

-

The C Shape Of The Tracheal Cartilages Is Important Because

Mar 17, 2025

-

Least Common Multiple Of 5 6 7

Mar 17, 2025

-

How Do You Find The Inverse Of A Relation

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is Not A Transfer Payment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.