Which Of The Following Is An Example Of Deflation

Juapaving

Mar 17, 2025 · 5 min read

Table of Contents

Which of the Following is an Example of Deflation? Understanding Deflationary Pressures

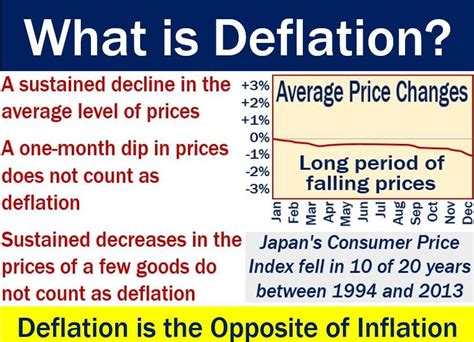

Deflation, a persistent decrease in the general price level of goods and services in an economy, is often misunderstood and its effects are far-reaching. While superficially attractive – imagine buying the same goods for less and less – deflation poses significant risks to economic stability and growth. Understanding what constitutes deflation is crucial to grasping its implications. This article will explore various scenarios and definitively answer the question: which of the following is an example of deflation? We'll analyze different economic situations, highlight key indicators, and examine the broader context of deflationary pressures.

Defining Deflation: More Than Just Falling Prices

It's important to differentiate between a single instance of price reduction and sustained deflation. A temporary drop in prices for a specific commodity, like a seasonal sale on winter coats, doesn't equate to deflation. Deflation refers to a broad, consistent decline in the overall price level across the economy over a considerable period, typically measured by indices like the Consumer Price Index (CPI) or the Producer Price Index (PPI). This persistent downward trend is the key characteristic.

Examples of Deflationary Scenarios: Identifying the Telltale Signs

Let's consider several scenarios and analyze whether they represent deflation:

Scenario 1: A nationwide sale on electronics after a technological breakthrough.

This is not an example of deflation. While consumers benefit from lower prices on electronics, this is a sector-specific price drop driven by technological advancements and increased supply. The overall price level of goods and services across the economy remains largely unaffected. This illustrates a crucial point: deflation affects the general price level, not just isolated instances.

Scenario 2: A decrease in oil prices due to increased global supply.

Similar to the previous example, a drop in oil prices, while impacting various sectors, doesn't automatically constitute deflation. While this decrease can lower transportation costs and the price of certain goods, it's not necessarily reflective of a broad, sustained decrease in the overall price level. The impact needs to be widespread across numerous sectors to qualify as deflation.

Scenario 3: A persistent decline in the CPI for three consecutive years.

This is a clear example of deflation. A sustained decrease in the CPI (Consumer Price Index) – a measure of the average change in prices paid by urban consumers for a basket of consumer goods and services – over multiple years strongly indicates deflation. This signifies a broad-based price reduction across the economy. This scenario fulfills the criteria of consistent and widespread price decreases.

Scenario 4: Increased unemployment and reduced consumer spending leading to lower demand and subsequently lower prices.

This scenario represents a deflationary pressure. Reduced consumer spending directly affects demand. Businesses respond by lowering prices to stimulate demand, which can lead to deflation. This is a common cause of deflationary spirals, where decreasing demand triggers lower prices, leading to further reduced spending and lower wages.

Scenario 5: A strong increase in the value of a nation's currency.

A strong currency can lead to import deflation. When the value of a nation's currency rises, imported goods become cheaper. This can put downward pressure on domestic prices, especially for imported goods and services. However, this is only one contributing factor to overall deflation, and the impact on domestic prices needs to be widespread to qualify as overall deflation.

Scenario 6: Increased productivity leading to lower production costs and subsequently lower prices.

Improved productivity can lead to cost-push deflation. While this may lower the prices of goods and services, this isn't necessarily a sign of economic hardship. The key distinction here lies in the underlying causes. Deflation resulting from increased productivity and efficiency is generally considered positive, unlike deflation arising from reduced demand and economic recession.

The Dangers of Deflation: Understanding the Negative Consequences

While lower prices might initially seem beneficial to consumers, sustained deflation poses serious risks:

-

Deflationary Spiral: Falling prices lead to reduced consumer spending as people postpone purchases expecting further price drops. This decreased demand triggers further price cuts by businesses, creating a vicious cycle that can spiral the economy downwards.

-

Increased Debt Burden: Deflation increases the real value of debt. As prices fall, the real value of outstanding loans increases, making it harder for individuals and businesses to repay their debts, potentially leading to defaults and financial instability.

-

Reduced Investment: Businesses are less likely to invest when they anticipate lower prices and reduced demand for their products. This can stifle economic growth and job creation.

-

Lower Wages: Deflation can put downward pressure on wages as businesses struggle to maintain profitability in a declining price environment. This can lead to reduced consumer spending, exacerbating the deflationary spiral.

Identifying Deflation: Key Indicators and Data Analysis

Several key indicators help economists and analysts identify deflationary pressures and trends:

-

Consumer Price Index (CPI): Tracks the average change in prices paid by urban consumers for a basket of goods and services. A consistently falling CPI is a strong indicator of deflation.

-

Producer Price Index (PPI): Measures the average change over time in the selling prices received by domestic producers for their output. A falling PPI signals deflationary pressures originating at the production level.

-

GDP Deflator: A measure of the average price level of all final goods and services produced in an economy. It provides a broader picture of price changes compared to CPI and PPI.

-

Real Wages: Comparing nominal wages (actual wages earned) to the inflation rate helps assess whether real purchasing power is increasing or decreasing. Falling real wages often accompany deflationary periods.

Analyzing these indicators alongside other macroeconomic data, such as employment rates, consumer confidence, and investment levels, provides a more comprehensive understanding of the economic situation and the presence of deflationary pressures.

Conclusion: Understanding Deflation's Nuances

Determining whether a given scenario constitutes deflation requires careful examination of the context and broad economic trends. A single instance of price reduction is not indicative of deflation. Instead, sustained and widespread decreases in the general price level, as reflected in indices like the CPI and PPI, coupled with other macroeconomic indicators, are crucial to confirming a deflationary environment. While lower prices might seem attractive, the potential consequences of a deflationary spiral are significant and necessitate proactive measures by governments and central banks to mitigate the risks. Understanding the intricacies of deflation is crucial for both economic policymakers and individuals navigating the complex landscape of economic fluctuations.

Latest Posts

Latest Posts

-

Is Square Root Of 9 A Rational Number

Mar 17, 2025

-

5 Letter Word With Er At The End

Mar 17, 2025

-

A Quadrilateral With Parallel Opposite Sides

Mar 17, 2025

-

What Is An Operator In Biology

Mar 17, 2025

-

How Many Symmetry Lines Does A Square Have

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is An Example Of Deflation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.