What Is The Normal Balance Of Accumulated Depreciation

Juapaving

Mar 27, 2025 · 6 min read

Table of Contents

- What Is The Normal Balance Of Accumulated Depreciation

- Table of Contents

- What is the Normal Balance of Accumulated Depreciation?

- Understanding Accumulated Depreciation

- Why is the Normal Balance a Debit? The Contra-Asset Nature

- Calculating Accumulated Depreciation

- Accumulated Depreciation on the Balance Sheet

- Common Misconceptions about Accumulated Depreciation

- Impact on Financial Statements and Analysis

- Conclusion: Mastering Accumulated Depreciation

- Latest Posts

- Latest Posts

- Related Post

What is the Normal Balance of Accumulated Depreciation?

Understanding the normal balance of accumulated depreciation is crucial for accurate financial reporting and analysis. This comprehensive guide delves into the concept, explaining its nature, how it's calculated, its impact on the balance sheet, and common misconceptions. We'll also explore practical examples to solidify your understanding.

Understanding Accumulated Depreciation

Accumulated depreciation represents the total depreciation expense recorded for an asset since its acquisition. It's a contra-asset account, meaning it reduces the value of an asset on the balance sheet. Unlike depreciation expense, which is an income statement account reflecting the depreciation for a specific period, accumulated depreciation is a balance sheet account accumulating the depreciation over the asset's entire life.

Think of it this way: you buy a machine for $10,000. Over its useful life, you record depreciation expense annually. Accumulated depreciation tracks the cumulative amount of depreciation expensed, growing each year until it equals the asset's original cost less its salvage value (if any).

Key Characteristics of Accumulated Depreciation:

- Contra-Asset Account: It offsets the value of a fixed asset.

- Balance Sheet Account: It's reported on the balance sheet, not the income statement.

- Cumulative: It reflects the total depreciation recorded over the asset's life.

- Normal Debit Balance: This is the key takeaway – the normal balance of accumulated depreciation is a debit. This might seem counterintuitive since it reduces the asset's value, but it's crucial to understand the accounting principles behind it.

Why is the Normal Balance a Debit? The Contra-Asset Nature

The normal balance of an account is determined by its nature. Assets typically have debit balances. Liabilities and Equity have credit balances. Accumulated depreciation, while reducing an asset's value, is not itself an asset. It's a reduction of an asset. Therefore, it follows the opposite convention of its related asset account.

Consider this analogy: You have $100 in your checking account (asset – debit balance). You write a check for $20 (contra-asset reducing the cash). To record the check's outflow, you increase the debit side of the expense account and reduce the asset (cash). To show the reduction in cash, you credit cash, which decreases the cash account. Similarly, accumulated depreciation uses a debit balance to reduce the asset's book value.

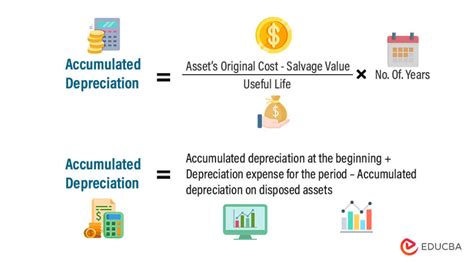

Calculating Accumulated Depreciation

The calculation of accumulated depreciation depends on the depreciation method used. Several methods exist, each with its own formula:

1. Straight-Line Depreciation:

This is the simplest method, where depreciation is evenly spread over the asset's useful life.

- Formula: (Asset Cost - Salvage Value) / Useful Life

Example: A machine costing $10,000 with a $1,000 salvage value and a 5-year useful life has an annual depreciation of ($10,000 - $1,000) / 5 = $1,800.

After Year 1: Accumulated Depreciation = $1,800 After Year 2: Accumulated Depreciation = $3,600 After Year 3: Accumulated Depreciation = $5,400 and so on...

2. Double-Declining Balance Depreciation:

This is an accelerated depreciation method, resulting in higher depreciation expense in the early years.

- Formula: 2 * (Straight-Line Depreciation Rate) * (Book Value at the Beginning of the Year)

Example: Using the same machine above, the straight-line rate is 20% (1/5).

Year 1: 2 * 20% * $10,000 = $4,000 Year 2: 2 * 20% * ($10,000 - $4,000) = $2,400 Year 3: 2 * 20% * ($10,000 - $4,000 - $2,400) = $1,440 and so on... Note that the salvage value is considered only at the end to ensure the book value doesn't go below it.

3. Units of Production Depreciation:

This method bases depreciation on the actual use of the asset.

- Formula: ((Asset Cost - Salvage Value) / Total Units to be Produced) * Units Produced During the Year

Example: If the machine above is expected to produce 100,000 units over its life, and it produced 20,000 units in Year 1:

Year 1: (($10,000 - $1,000) / 100,000) * 20,000 = $1,800 The accumulated depreciation would continue to be calculated based on the units produced each year.

Accumulated Depreciation on the Balance Sheet

Accumulated depreciation is presented on the balance sheet as a deduction from the related asset's cost. This results in the net book value of the asset.

Example:

| Asset | Cost | Accumulated Depreciation | Net Book Value |

|---|---|---|---|

| Machinery | $10,000 | $3,600 | $6,400 |

| Building | $500,000 | $150,000 | $350,000 |

The net book value reflects the asset's value after considering the accumulated depreciation. It's an important figure for assessing the asset's current worth and for financial reporting purposes.

Common Misconceptions about Accumulated Depreciation

1. Accumulated Depreciation is a Loss: Accumulated depreciation is not a loss. It's an allocation of the asset's cost over its useful life. Losses are recorded separately on the income statement.

2. Accumulated Depreciation Represents Cash: Accumulated depreciation doesn't represent cash. It's a non-cash expense that affects the book value of an asset.

3. Accumulated Depreciation Should Always Equal the Asset's Cost: This isn't necessarily true. It will only equal the original cost if the asset is fully depreciated and has no salvage value. Otherwise, the net book value will reflect the asset's remaining book value.

4. The Depreciation Method Doesn't Matter: The choice of depreciation method impacts the timing of depreciation expense and therefore the net book value. Choosing the right method aligns with the asset's actual usage and wear and tear. This is particularly important in regulatory and taxation settings.

Impact on Financial Statements and Analysis

Accumulated depreciation significantly influences several key financial statements and ratios:

- Balance Sheet: It directly affects the asset section of the balance sheet, reducing the total assets reported. The net book value provides a more realistic view of asset worth.

- Income Statement: Depreciation expense (not accumulated depreciation) appears on the income statement, impacting net income. The method chosen directly affects the level of net income recorded.

- Cash Flow Statement: Depreciation is a non-cash expense, but it's added back to net income in the operating activities section of the cash flow statement. This reflects that depreciation doesn't affect actual cash flows.

- Financial Ratios: Accumulated depreciation indirectly affects many financial ratios, such as return on assets (ROA) and asset turnover, by impacting the asset base used in calculations.

Conclusion: Mastering Accumulated Depreciation

Understanding the normal balance of accumulated depreciation – a debit – and its role in financial reporting is vital for accurate financial statement preparation and analysis. By grasping its contra-asset nature and the implications of various depreciation methods, you'll gain a comprehensive understanding of this critical accounting concept. Remember, accumulated depreciation provides a more realistic picture of asset value and its impact on profitability and financial health. Continuous learning and careful application of these concepts are crucial for sound financial management.

Latest Posts

Latest Posts

-

Do Both Prokaryotic And Eukaryotic Cells Have Ribosomes

Mar 31, 2025

-

Which Law Represents A Balanced Chemical Equation

Mar 31, 2025

-

How To Calculate Tension In A Cable

Mar 31, 2025

-

Solve The Equation Round To The Nearest Hundredth

Mar 31, 2025

-

A Tool With A Curved Blade

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about What Is The Normal Balance Of Accumulated Depreciation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.