What Is The Marginal Opportunity Cost

Juapaving

Mar 31, 2025 · 8 min read

Table of Contents

What is Marginal Opportunity Cost? A Deep Dive

Understanding opportunity cost is crucial for making sound economic decisions, both on a personal and a business level. While the concept of opportunity cost itself is relatively straightforward – the value of the next best alternative forgone – the marginal opportunity cost takes this a step further, focusing on the cost of one additional unit of something. This nuanced perspective offers a much more precise understanding of trade-offs and the efficient allocation of resources. This article will delve deep into the concept of marginal opportunity cost, exploring its definition, applications, calculations, and its significance in various fields.

Defining Marginal Opportunity Cost

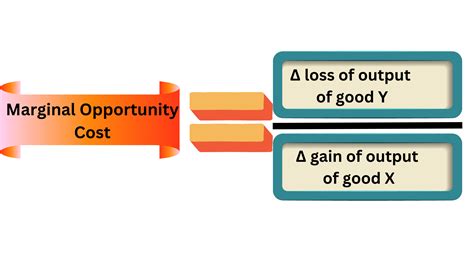

Marginal opportunity cost (MOC) represents the value of the next best alternative that is sacrificed when choosing to produce or consume one more unit of a good or service. It's the incremental increase in cost associated with producing or consuming an additional unit. Unlike the total opportunity cost, which considers all forgone alternatives, MOC focuses solely on the cost of the next unit. This precision allows for a more refined analysis of resource allocation, particularly at the individual, firm, and societal levels.

Think of it this way: you're deciding how many hours to spend studying for an exam versus working a part-time job. The total opportunity cost of studying for 5 hours might be the total potential earnings you missed. However, the marginal opportunity cost of studying that fifth hour is specifically the wages you would have earned during that specific hour. This is the incremental cost of that additional hour dedicated to studying.

Key Differences from Total Opportunity Cost

It's important to differentiate marginal opportunity cost from total opportunity cost:

- Total Opportunity Cost: This encompasses the total value of all forgone alternatives when making a choice. It represents the entire sacrifice incurred.

- Marginal Opportunity Cost: This focuses on the value of the forgone alternative associated with just one more unit of the chosen activity. It's the cost of the next increment.

The marginal opportunity cost provides a more dynamic and nuanced understanding of decision-making, reflecting the changing cost implications as more units are produced or consumed.

Calculating Marginal Opportunity Cost

Calculating marginal opportunity cost involves analyzing the trade-off between two goods or activities. Let's illustrate this with an example:

Imagine a farmer who can produce either wheat or corn using the same resources (land, labor, equipment). The farmer's production possibilities are as follows:

| Wheat (Bushels) | Corn (Bushels) |

|---|---|

| 0 | 100 |

| 20 | 80 |

| 40 | 50 |

| 60 | 10 |

| 80 | 0 |

To calculate the marginal opportunity cost of producing one more bushel of wheat, we look at the change in corn production for each additional bushel of wheat:

-

Moving from 0 to 20 bushels of wheat: The opportunity cost of producing the first 20 bushels of wheat is 20 bushels of corn (100 - 80). The marginal opportunity cost is 20/20 = 1 bushel of corn per bushel of wheat.

-

Moving from 20 to 40 bushels of wheat: The opportunity cost of producing an additional 20 bushels of wheat is 30 bushels of corn (80 - 50). The marginal opportunity cost is 30/20 = 1.5 bushels of corn per bushel of wheat.

-

Moving from 40 to 60 bushels of wheat: The opportunity cost of producing another 20 bushels of wheat is 40 bushels of corn (50 - 10). The marginal opportunity cost is 40/20 = 2 bushels of corn per bushel of wheat.

-

Moving from 60 to 80 bushels of wheat: The opportunity cost of producing the final 20 bushels of wheat is 10 bushels of corn (10 - 0). The marginal opportunity cost is 10/20 = 0.5 bushels of corn per bushel of wheat.

As you can see, the marginal opportunity cost of wheat increases as more wheat is produced. This is because resources are not perfectly adaptable between wheat and corn production. As the farmer shifts more resources towards wheat, the productivity of those resources in corn production declines. This illustrates the concept of increasing marginal opportunity cost, a common phenomenon in many production scenarios.

Applications of Marginal Opportunity Cost

The concept of marginal opportunity cost finds application in diverse fields:

1. Business Decision-Making:

Businesses use MOC to analyze various investment opportunities. For instance, a company deciding whether to launch a new product line would consider the marginal opportunity cost of diverting resources from existing product lines. If the potential profits from the new line exceed the MOC, the investment might be worthwhile. MOC plays a crucial role in capital budgeting decisions, resource allocation, and production planning.

2. Government Policy:

Governments use MOC to assess the effectiveness of different policies. For example, the MOC of investing in infrastructure might be the forgone spending on education or healthcare. Understanding MOC helps policymakers make informed choices about resource allocation, balancing competing societal needs.

3. Personal Finance:

Individuals also face MOC decisions daily. Choosing between investing in stocks or saving in a bank account involves assessing the MOC of each choice. The opportunity cost of saving might be the potential higher returns from stocks, while the opportunity cost of investing in stocks might be the security and stability of a savings account.

4. Environmental Economics:

In environmental economics, MOC helps assess the cost of environmental degradation. For example, the MOC of polluting a river might be the lost value of clean water for recreation or fishing. MOC aids in the cost-benefit analysis of environmental policies.

Increasing and Decreasing Marginal Opportunity Cost

As illustrated in the farming example, marginal opportunity cost isn't always constant. It can increase or decrease depending on the production possibilities:

-

Increasing Marginal Opportunity Cost: This is the most common scenario, reflecting the law of diminishing returns. As more of one good is produced, the opportunity cost of producing additional units increases because resources are less adaptable to the production of that good. The production possibilities frontier (PPF) will be concave to the origin.

-

Decreasing Marginal Opportunity Cost: This is less frequent but can occur in situations where specialization and economies of scale are significant. As more of one good is produced, the opportunity cost of producing additional units might decrease due to increased efficiency and specialization of resources. The PPF will be convex to the origin.

-

Constant Marginal Opportunity Cost: This is a theoretical case where the opportunity cost remains constant regardless of the quantity produced. This scenario is rare in real-world situations. The PPF is a straight line.

Understanding the nature of the marginal opportunity cost—whether increasing, decreasing, or constant—is vital for accurate economic analysis and decision-making.

The Role of Marginal Opportunity Cost in Economic Models

Marginal opportunity cost is a fundamental concept in several core economic models:

1. Production Possibilities Frontier (PPF):

The PPF graphically illustrates the trade-offs between producing two goods. The slope of the PPF at any point represents the marginal opportunity cost of producing one good in terms of the other. A steeper slope indicates a higher MOC.

2. Consumer Choice Theory:

Consumer choice theory utilizes the concept of marginal rate of substitution (MRS), which is closely related to MOC. MRS represents the rate at which a consumer is willing to trade one good for another while maintaining the same level of utility. In many cases, MRS is a direct reflection of the MOC faced by the consumer.

3. Supply and Demand:

The supply curve can be interpreted as showing the marginal opportunity cost of production. As more of a good is produced, the marginal cost (and thus the MOC) typically rises, leading to an upward-sloping supply curve.

Limitations of Marginal Opportunity Cost

While incredibly valuable, marginal opportunity cost analysis has some limitations:

-

Information Asymmetry: Accurate MOC calculation requires complete and accurate information about the alternatives. This isn't always feasible, especially in complex scenarios.

-

Uncertain Future: MOC calculations often rely on projections and estimations of future costs and benefits. Uncertainty about the future can affect the accuracy of MOC assessments.

-

Intangible Costs: Some opportunity costs are difficult to quantify, particularly intangible factors like environmental impact, social wellbeing, or aesthetic considerations.

-

Dynamic Environments: In dynamic markets, costs and benefits can change rapidly, rendering MOC calculations based on static data obsolete.

Conclusion

Marginal opportunity cost is a powerful analytical tool that offers a nuanced and precise understanding of trade-offs in decision-making. Its applications span various fields, from personal finance and business strategy to government policy and environmental economics. While there are limitations to its applicability, understanding MOC is vital for making informed and efficient resource allocation choices. By appreciating the marginal cost of each decision, individuals, businesses, and governments can make more rational choices and optimize outcomes. The ability to recognize and quantify the marginal opportunity cost is a cornerstone of effective economic reasoning and contributes significantly to successful decision-making across a wide array of contexts.

Latest Posts

Latest Posts

-

Cartilaginous Fishes And Bony Fishes Are Different In That Only

Apr 02, 2025

-

According To Bronsted Lowry Theory An Acid Is

Apr 02, 2025

-

Square Square Roots Cubes And Cube Roots

Apr 02, 2025

-

How Many Cm Is 70 Inches

Apr 02, 2025

-

A Letter Or Symbol That Represents A Missing Value

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about What Is The Marginal Opportunity Cost . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.