The Demand Curve For A Monopolist Is

Juapaving

Mar 21, 2025 · 7 min read

Table of Contents

The Demand Curve for a Monopolist: A Deep Dive

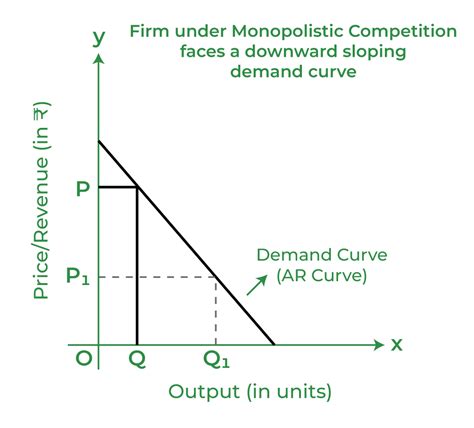

The demand curve for a monopolist is fundamentally different from that faced by firms in perfectly competitive markets. Understanding this difference is crucial to grasping monopolistic behavior, pricing strategies, and the overall impact on the market. While a perfectly competitive firm faces a horizontal demand curve, indicating it can sell any quantity at the prevailing market price, a monopolist confronts a downward-sloping demand curve. This signifies that to sell more units, the monopolist must lower its price. This seemingly simple distinction leads to profound implications for output, pricing, and societal welfare.

Understanding the Downward-Sloping Demand Curve

The downward-sloping demand curve for a monopolist is a direct consequence of its market dominance. As the sole provider of a particular good or service, the monopolist has no direct competitors. This unique position grants it significant market power, allowing it to influence the price-quantity relationship. The monopolist's demand curve is, in fact, the market demand curve itself. This means the quantity demanded is directly related to the price charged; higher prices lead to lower quantities demanded, and vice versa.

This is in stark contrast to a perfectly competitive firm. A perfectly competitive firm is a "price taker," meaning it accepts the market-determined price as given. It can sell any quantity at that price, but it cannot influence it. Its demand curve is perfectly elastic (horizontal) at the market price.

The Relationship Between Price and Quantity Demanded

For a monopolist, the relationship between price and quantity demanded is inversely proportional. This is captured by the downward slope of the demand curve. If the monopolist wants to sell a larger quantity, it must reduce its price. This is because consumers are generally more willing to purchase goods at lower prices. The willingness of consumers to buy at various prices is precisely what the demand curve depicts.

Implications of the Downward-Sloping Demand Curve

The downward-sloping demand curve has several crucial implications for a monopolist's decision-making:

-

Revenue Maximization is Not Output Maximization: Unlike a perfectly competitive firm that maximizes profit by producing at the point where marginal cost equals market price, a monopolist faces a more complex optimization problem. Since the monopolist faces a downward-sloping demand curve, increasing output requires lowering the price, affecting both the quantity sold and the price received for each unit. This necessitates the analysis of marginal revenue, which is always less than the price for a monopolist. To maximize profit, the monopolist must produce where marginal revenue equals marginal cost, resulting in a lower output level than what would be produced in a competitive market.

-

Price Discrimination Possibilities: The downward-sloping demand curve creates opportunities for price discrimination. Price discrimination is the practice of charging different prices to different consumers for the same good or service. This is possible because the monopolist can segment the market based on consumers' willingness to pay. For instance, a monopolist might charge a higher price to consumers with a higher willingness to pay and a lower price to consumers with a lower willingness to pay. This allows the monopolist to extract more consumer surplus.

-

Deadweight Loss: Due to the restricted output and higher prices associated with monopolies, there is a loss of allocative efficiency. The quantity produced by a monopolist is less than the socially optimal quantity, which occurs where marginal cost equals market demand. The difference between the socially optimal quantity and the monopolist's output level results in a deadweight loss, representing a reduction in overall social welfare.

-

Higher Profit Margins: Because of the lack of competition, monopolists can maintain higher profit margins compared to firms in competitive markets. This arises from their ability to control both price and quantity. However, this higher profit is often offset by lower production volumes and the potential for government intervention.

Analyzing the Monopolist's Demand Curve with Examples

Let's illustrate the monopolist's demand curve with a few examples:

Example 1: A Pharmaceutical Company with a Patented Drug

Imagine a pharmaceutical company that holds a patent for a life-saving drug. This patent grants the company a monopoly in the market for that specific drug. The demand curve for this drug will be downward sloping. If the company charges a very high price, only a few consumers will be able to afford it. To sell more units, the company must lower the price. The company's profit maximization point will be where its marginal revenue equals its marginal cost, leading to a price higher and a quantity lower than would occur in a competitive market.

Example 2: A Utility Company

A utility company, such as an electricity provider in a geographically isolated area, might possess a local monopoly. The demand curve for electricity in this region will be downward sloping. The utility company can charge higher prices, leading to less consumption, or lower prices, leading to more consumption. However, government regulations might intervene to prevent excessive pricing.

Example 3: A Software Company with a Dominating Product

Consider a software company that has developed an operating system that's become the industry standard. This creates a quasi-monopoly, where the company dominates the market but faces some limited competition. The demand curve for this operating system is still downward sloping, though the slope might be less steep than in a pure monopoly due to the presence of substitute products.

Factors Affecting the Monopolist's Demand Curve

Several factors can influence the shape and position of a monopolist's demand curve:

-

Price Elasticity of Demand: The elasticity of demand significantly influences the monopolist's pricing strategy. If demand is highly elastic (responsive to price changes), the monopolist will be less inclined to charge high prices, as even small price increases will lead to a significant drop in quantity demanded. Conversely, if demand is inelastic (less responsive to price changes), the monopolist can charge higher prices without significantly impacting quantity demanded.

-

Availability of Substitutes: The presence of substitutes, even imperfect ones, can affect the monopolist's demand curve. If close substitutes are available, the demand for the monopolist's product will be more elastic. Consumers will be more likely to switch to substitutes if the monopolist raises prices.

-

Consumer Income: Changes in consumer income can shift the demand curve. If consumer income rises, the demand curve might shift to the right (an increase in demand), and vice versa.

-

Consumer Tastes and Preferences: Shifts in consumer tastes and preferences can also affect the demand curve. If consumer preferences shift away from the monopolist's product, the demand curve will shift to the left (a decrease in demand).

-

Government Regulations: Government regulations, such as price ceilings or subsidies, can directly affect the monopolist's demand curve. A price ceiling imposes an upper limit on the price a monopolist can charge, altering the effective demand curve. Subsidies, on the other hand, can shift the demand curve to the right.

The Monopolist's Demand Curve and Profit Maximization

The monopolist's profit maximization strategy is intricately linked to its downward-sloping demand curve. The monopolist doesn't simply equate marginal cost with price, as in perfect competition. Instead, it must consider the relationship between price, quantity, and marginal revenue.

Because each additional unit sold requires a price reduction across all units sold, the marginal revenue curve lies below the demand curve. The monopolist's profit-maximizing output occurs where marginal revenue equals marginal cost. The price charged corresponds to the point on the demand curve associated with that quantity.

This profit-maximizing point results in a higher price and a lower quantity than in a perfectly competitive market, leading to a deadweight loss and a reduction in social welfare. The difference between the monopolist's price and its marginal cost represents the extent of its market power and its ability to extract economic profits.

Conclusion: The Significance of the Downward-Sloping Demand Curve

The downward-sloping demand curve is a defining characteristic of a monopoly. It's not merely a theoretical concept; it's a crucial factor influencing the pricing decisions, output levels, and overall market behavior of a monopolist. Understanding this fundamental aspect of monopolies is essential for analyzing their economic impact, evaluating government policies aimed at regulating monopolies, and appreciating the contrast with the competitive model. The shape and position of this curve are constantly influenced by various market forces and governmental interventions, creating a complex and dynamic market landscape. The consequences of this downward-sloping demand, such as reduced output, higher prices, and deadweight losses, underscore the importance of studying and understanding monopolistic market structures.

Latest Posts

Latest Posts

-

Sum Of Interior Angles Of A Trapezoid

Mar 22, 2025

-

What Is The Lowest Common Factor Of 16 And 40

Mar 22, 2025

-

What Is The Reciprocal Of 8 3

Mar 22, 2025

-

Three Physical Properties Of Ionic Compounds

Mar 22, 2025

-

Which Of The Following Numbers Are Multiples Of 8

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about The Demand Curve For A Monopolist Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.