The Demand Curve Faced By A Perfectly Competitive Firm Is

Juapaving

Mar 17, 2025 · 6 min read

Table of Contents

The Demand Curve Faced by a Perfectly Competitive Firm: A Comprehensive Guide

The demand curve faced by a perfectly competitive firm is a fundamental concept in microeconomics. Understanding this curve is crucial for grasping how firms make decisions in a perfectly competitive market, and how market prices are determined. This article will delve into the characteristics of this demand curve, contrasting it with the market demand curve, exploring its implications for pricing and output decisions, and examining the limitations of the perfectly competitive model.

Characteristics of a Perfectly Competitive Market

Before diving into the firm's demand curve, let's review the defining characteristics of a perfectly competitive market. These characteristics are crucial because they directly shape the demand conditions faced by individual firms:

-

Many buyers and sellers: A large number of buyers and sellers ensures that no single participant can influence the market price. This is the cornerstone of perfect competition.

-

Homogeneous products: Products offered by different firms are identical or nearly identical. Buyers see no difference between products from various producers. This eliminates any brand loyalty or preference that might distort pricing.

-

Free entry and exit: Firms can easily enter or exit the market without significant barriers. This prevents excessive profits in the long run and ensures that resources are allocated efficiently.

-

Perfect information: Buyers and sellers have complete knowledge of prices, quality, and other market conditions. This eliminates information asymmetry, preventing exploitation and ensuring fair transactions.

-

No transaction costs: There are no costs associated with buying or selling goods, such as transportation or advertising expenses. This assumption simplifies the model, focusing on the core price mechanism.

The Perfectly Competitive Firm's Demand Curve: Perfectly Elastic

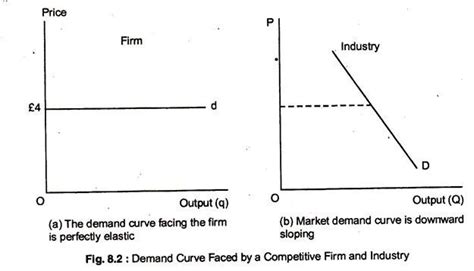

Unlike a monopolist who faces a downward-sloping demand curve, a perfectly competitive firm faces a perfectly elastic demand curve. This means the firm can sell as much output as it wants at the prevailing market price, but it cannot sell any output above that price. The demand curve is a horizontal line at the market price.

Why is the demand curve perfectly elastic?

The perfectly elastic demand curve stems directly from the characteristics of perfect competition:

-

Many sellers: Since there are many firms offering identical products, a single firm's output represents an insignificant portion of the total market supply. Therefore, the firm cannot influence the market price by altering its own output.

-

Homogeneous products: Consumers perceive all products as identical. If a firm tries to charge a price higher than the market price, buyers will simply switch to another firm offering the same product at the lower price. The firm will lose all its customers.

-

Perfect information: Consumers are fully aware of the market price. If a firm attempts price gouging, consumers will immediately know they can buy the same product elsewhere at a lower cost.

Graphical Representation

The demand curve (D) for a perfectly competitive firm is depicted as a horizontal line at the prevailing market price (P*). This is contrasted with the downward-sloping market demand curve (D<sub>m</sub>), which shows the relationship between the market price and the total quantity demanded by all consumers:

[Insert a graph here showing a horizontal firm demand curve (D) at price P*, intersecting with the firm's marginal cost (MC) and average total cost (ATC) curves. The market demand curve (Dm) should be shown as a downward-sloping curve in a separate graph or as an inset to highlight the difference. ]

In the graph, the horizontal demand curve indicates that the firm can sell any quantity (Q) at the price P*. If it attempts to charge a higher price, its quantity demanded will drop to zero.

Profit Maximization and the Firm's Supply Curve

For a profit-maximizing firm, the decision on how much output to produce hinges on comparing marginal cost (MC) with marginal revenue (MR). In perfect competition, the marginal revenue is simply equal to the market price (P*). This is because each additional unit sold brings in the same revenue – the market price.

Therefore, the profit-maximizing output level is where MC = MR = P.*

The firm's supply curve is the portion of its marginal cost curve that lies above its average variable cost (AVC) curve. This is because a firm will only produce in the short run if it can cover its variable costs. If the market price falls below the minimum AVC, the firm will shut down.

[Insert a graph here showing the firm's short-run supply curve as the portion of the MC curve above the AVC curve.]

Short-Run and Long-Run Equilibrium

Short-run equilibrium: In the short run, firms can earn economic profits, normal profits, or suffer losses depending on the market price. If the market price is above the average total cost (ATC), firms earn positive economic profits. If it's equal to ATC, firms earn normal profits (zero economic profits). If it's below ATC but above AVC, firms suffer losses but continue producing in the short run to minimize losses.

Long-run equilibrium: In the long run, free entry and exit eliminate economic profits. If firms are earning positive economic profits, new firms will enter the market, increasing supply and driving down the price. Conversely, if firms are suffering losses, some firms will exit the market, reducing supply and increasing the price. This process continues until the market price equals the minimum average total cost, resulting in zero economic profit. At this point, the industry is in long-run equilibrium.

Limitations of the Perfect Competition Model

While the perfectly competitive model provides a valuable benchmark for understanding market mechanisms, it's important to acknowledge its limitations:

-

Homogeneous products are rare: In reality, most products have some degree of differentiation, either in terms of quality, features, branding, or location.

-

Perfect information is unrealistic: Consumers rarely have complete information about all available products and prices.

-

Free entry and exit are often restricted: Barriers to entry, such as high start-up costs, patents, or government regulations, can prevent new firms from entering the market easily.

-

Zero transaction costs are an oversimplification: Transaction costs, such as transportation and advertising, are inherent in most markets.

Real-World Applications and Relevance

Despite its simplifying assumptions, the perfectly competitive model serves as a useful framework for analyzing many real-world markets, particularly those with a large number of relatively small firms, such as agricultural markets (e.g., wheat, corn) and some online marketplaces for standardized products. While perfectly competitive conditions are rarely perfectly met, understanding the principles of this model offers insights into how market forces influence pricing, output, and resource allocation in various market structures.

Conclusion

The demand curve faced by a perfectly competitive firm is a horizontal line at the market price, representing perfect elasticity. This stems from the defining characteristics of perfect competition: many buyers and sellers, homogeneous products, free entry and exit, perfect information, and zero transaction costs. Understanding this demand curve is crucial for analyzing the firm's profit-maximizing output level, its supply curve, and the short-run and long-run equilibrium of the market. While the perfectly competitive model is a simplification of real-world markets, it offers a powerful analytical tool for understanding fundamental economic principles and their implications for market behavior. By grasping the specifics of this model, we gain a valuable perspective on how competitive forces shape pricing, output, and resource allocation in a wide range of markets.

Latest Posts

Latest Posts

-

Who Was The Father Of The Renaissance

Mar 18, 2025

-

66 As A Product Of Prime Factors

Mar 18, 2025

-

Vertical And Horizontal Lines On A Graph

Mar 18, 2025

-

Lcm Of 8 12 And 15

Mar 18, 2025

-

Is 55 A Prime Or Composite Number

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Demand Curve Faced By A Perfectly Competitive Firm Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.