1800 In Words For A Check

Juapaving

Mar 29, 2025 · 5 min read

Table of Contents

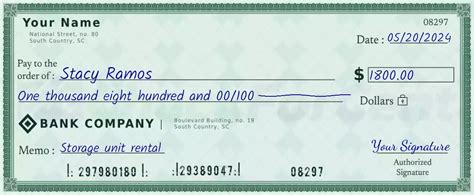

1800 in Words: A Comprehensive Guide to Writing Checks for $1,800

Writing a check for a significant amount like $1,800 requires precision and accuracy. A single mistake can lead to delays, disputes, or even bounced checks. This comprehensive guide will walk you through the process step-by-step, explaining each element and offering tips to ensure accuracy and avoid common errors. We'll cover everything from understanding the different parts of a check to best practices for security and record-keeping.

Understanding the Anatomy of a Check

Before diving into writing a check for $1,800, it's crucial to understand the different components:

1. Payee Line: Who Receives the Money?

This is where you write the name of the person or entity receiving the payment. For a $1,800 check, write the name exactly as it appears on their official documentation, such as an invoice or contract. Avoid abbreviations or nicknames. For example, if you're paying "Acme Corporation," write "Acme Corporation," not "Acme Corp." or "Acme." Accuracy is paramount here.

2. Numeric Amount: The $1,800 Figure

This section involves writing the numerical amount of the check. Clearly write "1800.00." Leave no space between the number and the decimal point, and always include the cents, even if they're zero. This ensures clarity and prevents potential misinterpretations or fraudulent alterations.

3. Alphabetic Amount: Writing Out $1,800 in Words

This is perhaps the most critical part, and the reason for this article's title. You must write out the amount in words. For $1,800, this would be "One thousand eight hundred and 00/100." Never abbreviate; always write the full amount. This is a crucial security measure against check fraud. Writing it out in full provides an additional layer of verification.

Here's a breakdown of why this step is crucial: The numerical amount and the written amount should always match. If there's a discrepancy, the bank will likely refuse to process the check. Writing out the amount in words is a critical safeguard. Even a small mistake like omitting "and" can lead to problems.

4. Memo Line: Providing Context

The memo line is optional but highly recommended. Use it to briefly explain the purpose of the payment. For example, you might write "Rent Payment," "Invoice #12345," or "Car Down Payment." This provides a clear record of the transaction for both you and the recipient. This extra information is particularly helpful for bookkeeping and tax purposes.

5. Date: When the Check is Issued

Write the date you are issuing the check in the designated space. Use the standard month/day/year format (e.g., 03/15/2024). Ensure the date is legible and unambiguous. Avoid dating checks far in advance.

6. Signer Line: Your Signature

Sign the check in the space provided. Use the same signature you use on all your important documents. This verifies the authenticity of the check. Never sign a blank check.

Common Mistakes to Avoid When Writing a $1800 Check

Avoiding common errors is key to ensuring your $1,800 check is processed smoothly. Here are some crucial points to remember:

- Misspellings: Double-check the payee's name for accuracy. Even a slight misspelling could delay or prevent payment.

- Inconsistent Number and Word Amounts: The numerical and written amounts must match precisely. Any discrepancy will result in the check being rejected.

- Missing Cents: Always include the cents, even if they are zeros (00/100).

- Illegible Handwriting: Ensure your writing is clear and easy to read. Ambiguous writing can lead to misinterpretations.

- Unsigned Checks: Never send an unsigned check. This is a major security risk.

- Insufficient Funds: Before writing the check, confirm you have sufficient funds in your account to cover the $1,800 amount. Bounced checks can damage your credit score and incur fees.

- Incorrect Date: Make sure the date is accurate and legible.

- Alterations: Avoid making any alterations to the check after it's written. This raises suspicion and could lead to rejection. If you make a mistake, void the check and write a new one.

Best Practices for Writing and Handling Checks for Large Amounts

When dealing with large sums like $1,800, extra precautions are warranted. Consider these best practices:

- Use a Check Register: Maintain a meticulous check register to track all your checks. This ensures you have a record of all transactions and helps you manage your finances.

- Use Security Features: Some checks have security features like microprinting or watermarks. These features make them harder to counterfeit.

- Consider a Cashier's Check or Money Order: For extremely large amounts or situations requiring extra security, a cashier's check or money order might be a safer option. These are checks drawn on the bank's own funds, guaranteeing payment.

- Send via Certified Mail: When sending a check for $1,800, consider sending it via certified mail with a return receipt. This provides proof of delivery and helps mitigate the risk of loss or theft.

- Keep Copies: Always keep a copy of every check you write. This serves as a valuable record for your accounting and tax purposes. Digital scanning is also a good way to preserve your checks.

- Review Your Bank Statements Regularly: Check your bank statements regularly to ensure all your checks have cleared and to detect any discrepancies or unauthorized activity.

Additional Tips for Security and Accuracy

- Use a Check Writing Software: Several software applications are designed specifically to generate checks electronically, minimizing the risk of errors and enhancing security.

- Avoid Using Abbreviations: When writing the payee's name or the amount in words, use the full legal name or the complete written amount.

- Be Mindful of Check Fraud: Be aware of check fraud schemes. Never give out your check number or banking information to anyone you don't trust.

- Report Lost or Stolen Checks Immediately: If a check is lost or stolen, contact your bank immediately to stop payment.

Writing a check for $1,800 involves careful attention to detail. Following these steps and adhering to best practices will help ensure the transaction is smooth, accurate, and secure. Remember, accuracy is key to avoiding delays, disputes, and financial complications. Take your time, double-check your work, and ensure the recipient receives their payment without any issues. By following this comprehensive guide, you'll gain the confidence to manage significant financial transactions efficiently and safely.

Latest Posts

Latest Posts

-

The Protein Coat Of A Virus Is Called

Mar 31, 2025

-

Melting Of Wax Is A Physical Or Chemical Change

Mar 31, 2025

-

What Is 35 Cm In Inches

Mar 31, 2025

-

How Many Feet In 44 Inches

Mar 31, 2025

-

What Is The Difference Between An Ecosystem And An Environment

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about 1800 In Words For A Check . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.