Which Of The Following Are Characteristics Of A Competitive Market

Juapaving

Mar 27, 2025 · 6 min read

Table of Contents

Which of the Following are Characteristics of a Competitive Market? A Deep Dive

The concept of a competitive market is fundamental to economics. Understanding its characteristics is crucial for businesses to strategize effectively and for economists to analyze market behavior. While the textbook definition often simplifies the reality, recognizing the key elements of a truly competitive market is essential for understanding how markets function and the forces that shape prices and output. This article will delve deep into the characteristics of a competitive market, exploring the nuances and exceptions to the rule.

Defining a Competitive Market: Beyond Perfect Competition

Before we dive into the specifics, it's important to clarify that we're discussing the idealized model of perfect competition, rather than the real-world markets we encounter daily. Perfect competition, while rarely observed in its purest form, provides a benchmark against which to measure the competitiveness of actual markets. Real-world markets often exhibit elements of competition but may deviate significantly from this theoretical ideal.

The key characteristics of a perfectly competitive market are often summarized using mnemonics (like "many buyers and sellers," "homogenous products," etc.), but a deeper understanding necessitates exploring each aspect individually and analyzing the implications of deviations from the ideal.

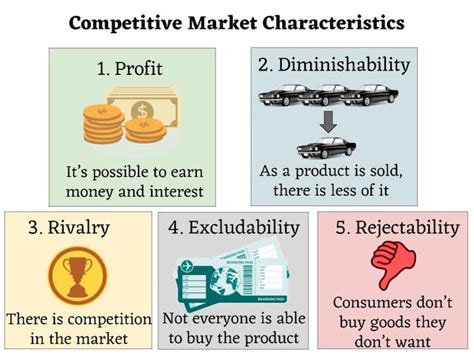

Key Characteristics of a Competitive Market (Perfect Competition):

1. Numerous Buyers and Sellers: The Power of Numbers

A truly competitive market boasts a large number of buyers and sellers, none of which hold significant market power. This means that no single participant can individually influence the market price. If one seller attempts to raise its price above the market equilibrium, buyers will simply shift their purchases to other sellers offering the same good or service at a lower price. Similarly, no single buyer can dictate the price; their influence is negligible compared to the overall market demand.

Implications of Deviation: When the number of buyers or sellers is limited (e.g., an oligopoly with a few dominant firms), market power emerges. Firms can exert influence on prices, leading to higher prices and lower output than in a perfectly competitive market. This is often seen in industries with high barriers to entry, like utilities or telecommunications.

2. Homogenous Products: Identical Goods and Services

In a perfectly competitive market, products are homogenous, meaning they are essentially identical or perfect substitutes. Consumers perceive no difference between the products offered by different sellers. This implies that the only basis for competition is price.

Implications of Deviation: Product differentiation is a common strategy used by firms to escape the intense price competition of a perfectly competitive market. Through branding, advertising, and unique features, firms create perceived differences between their products and those of competitors, allowing them to charge premium prices. This is the cornerstone of monopolistic competition.

3. Free Entry and Exit: The Dynamic Nature of Competition

The ability of firms to easily enter and exit the market is crucial for maintaining competition. Low barriers to entry prevent monopolies from forming, as new competitors can enter the market to challenge existing firms. Similarly, firms can exit the market if they are unprofitable, preventing the accumulation of inefficient businesses.

Implications of Deviation: High barriers to entry (e.g., high capital costs, regulatory restrictions, patents) can stifle competition, allowing existing firms to maintain market power and earn above-normal profits. This is common in industries with significant economies of scale, such as the pharmaceutical industry.

4. Perfect Information: Transparency and Knowledge

In a perfectly competitive market, both buyers and sellers have complete and perfect information about prices, product quality, and market conditions. This transparency allows for efficient resource allocation, as buyers can readily compare prices and sellers can respond quickly to changes in market demand.

Implications of Deviation: Information asymmetry, where one party has more information than the other, is a common characteristic of many markets. For example, sellers may possess more knowledge about product quality than buyers, leading to potential market inefficiencies. This information gap can be exploited by sellers, leading to higher prices or lower quality products. Government regulations often attempt to address this imbalance, such as mandatory labeling requirements.

5. Price Takers: No Individual Market Influence

In a perfectly competitive market, both buyers and sellers are price takers. This means they must accept the market price determined by the interaction of overall supply and demand. They have no influence on the price; they can only choose the quantity they want to buy or sell at that prevailing price.

Implications of Deviation: In markets with limited competition (e.g., monopolies or oligopolies), firms can influence prices through their output decisions. They are price makers, not price takers. This power allows them to charge higher prices than in a perfectly competitive market.

6. Mobility of Resources: Flexibility and Adaptation

In a perfectly competitive market, resources (labor, capital, etc.) are freely mobile and can be easily reallocated across different firms and industries. This ensures that resources are utilized efficiently in their most productive uses.

Implications of Deviation: Restrictions on resource mobility (e.g., labor unions, government regulations) can hinder the efficiency of resource allocation. This can lead to misallocation of resources and reduced overall economic output.

Analyzing Real-World Markets: Beyond the Ideal

While the idealized model of perfect competition rarely exists in its purest form, many real-world markets exhibit characteristics of competition to varying degrees. Understanding these characteristics allows for a more nuanced analysis of market behavior and the forces that shape prices and output. By comparing the characteristics of a given market to the attributes of perfect competition, we can assess its level of competitiveness and identify potential sources of market power or inefficiency.

Examples of Markets and their Competitive Characteristics:

Let's consider a few examples to illustrate how real-world markets often deviate from the idealized model:

-

Agricultural Markets (e.g., wheat, corn): These markets often approximate perfect competition more closely than many other industries. Many farmers produce similar products, entry and exit are relatively easy, and information about prices is relatively readily available. However, even here, factors like government subsidies and variations in crop yields can introduce deviations.

-

Retail Markets (e.g., clothing, groceries): These markets typically exhibit monopolistic competition. Numerous firms exist, but products are differentiated through branding and marketing. Entry and exit are relatively easy, but perfect information is not always present.

-

Pharmaceutical Markets: These markets often display characteristics of oligopoly, with a few large firms dominating the market for specific drugs. High barriers to entry (patents, research costs) and substantial product differentiation limit competition.

-

Utility Markets (e.g., electricity, water): These markets are frequently characterized by natural monopolies. High fixed costs and economies of scale make it inefficient to have multiple firms providing the service in a given area. Government regulation is often required to prevent exploitation of consumers.

Conclusion: A Dynamic and Evolving Landscape

The characteristics of a competitive market provide a crucial framework for understanding how markets function. While the idealized model of perfect competition rarely exists in its pure form, understanding its key elements allows economists and businesses alike to assess the degree of competition in various markets. This knowledge is critical for formulating effective business strategies, predicting market behavior, and designing appropriate regulatory interventions to promote efficient resource allocation and consumer welfare. The dynamic nature of markets necessitates a continuous reassessment of competitive conditions, taking into account evolving technologies, regulatory changes, and shifting consumer preferences. Analyzing these factors, in relation to the characteristics outlined above, allows for a deeper understanding of the complexities of the modern marketplace.

Latest Posts

Latest Posts

-

What Is The Interior Angle Sum Of A Regular Hexagon

Mar 30, 2025

-

Which Of The Following Organelles Breaks Down Worn Out Organelles

Mar 30, 2025

-

Distilled Water Does Not Conduct A Current

Mar 30, 2025

-

Square Root Of 30 In Radical Form

Mar 30, 2025

-

5 Letter Words Starting With Cor

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Are Characteristics Of A Competitive Market . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.