Which Items Influence The Trial Balance Agreement

Juapaving

Mar 25, 2025 · 7 min read

Table of Contents

Which Items Influence the Trial Balance Agreement?

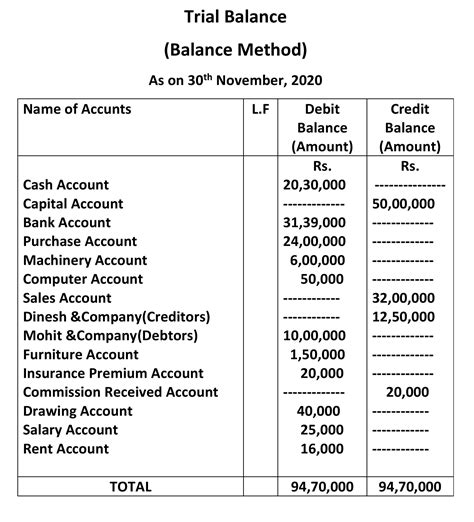

A trial balance is a critical report in accounting that summarizes all the balances of general ledger accounts at a specific point in time. The agreement, or lack thereof, of debit and credit balances signifies the accuracy of the bookkeeping process. However, numerous factors can influence the trial balance agreement, both positively and negatively. Understanding these influences is vital for maintaining accurate financial records and preventing costly errors.

Understanding the Trial Balance

Before diving into the influencing factors, let's briefly revisit what a trial balance is and why its agreement is crucial. Essentially, a trial balance lists all the accounts in the general ledger with their debit and credit balances. If the total debits equal the total credits, the trial balance is said to be "in agreement," suggesting that the double-entry bookkeeping system is functioning correctly. This doesn't guarantee complete accuracy—errors can still exist—but it's a strong indicator that the books are at least internally consistent. A disagreement, on the other hand, immediately signals an error somewhere in the accounting process.

Factors Influencing Trial Balance Agreement: Positive Influences

Several factors contribute to a trial balance being in agreement. These positive influences stem from sound accounting practices and meticulous record-keeping.

1. Accurate Data Entry: The Foundation of Agreement

Perhaps the most significant factor contributing to a balanced trial balance is precise data entry. Every transaction must be recorded accurately with the correct accounts, amounts, and debits/credits. Even a minor mistake, such as entering a wrong digit or posting to the incorrect account, can throw the trial balance out of balance. Implementing strong internal controls, such as double-checking entries and using accounting software with built-in error-checking features, minimizes the risk of data entry errors.

2. Consistent Application of Accounting Principles: Ensuring Accuracy

Adherence to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) is paramount. Inconsistencies in applying accounting principles will directly impact the accuracy of account balances, leading to a trial balance disagreement. For instance, inconsistent inventory valuation methods or depreciation calculations can cause discrepancies. Maintaining consistency is crucial for generating reliable financial reports.

3. Proper Use of Double-Entry Bookkeeping: The Core of Accuracy

The very foundation of accounting rests on the double-entry bookkeeping system. Every transaction affects at least two accounts—one with a debit entry and another with a credit entry. This ensures that the accounting equation (Assets = Liabilities + Equity) always remains balanced. A thorough understanding and correct application of this system are fundamental to achieving a trial balance agreement.

4. Regular Reconciliation of Accounts: Identifying and Correcting Errors Early

Regular reconciliation of accounts, such as bank reconciliations, accounts receivable reconciliations, and accounts payable reconciliations, is crucial. These reconciliations identify discrepancies between the general ledger and supporting documents, allowing for prompt correction of errors. This proactive approach prevents small errors from accumulating and causing a significant imbalance in the trial balance.

5. Effective Internal Controls: Preventing and Detecting Errors

Strong internal controls significantly reduce the risk of errors and fraud. These controls might include segregation of duties, authorization procedures, independent verification, and regular audits. By implementing a robust system of internal controls, organizations can enhance the accuracy of their financial records and ensure the trial balance remains in agreement.

Factors Influencing Trial Balance Agreement: Negative Influences

Conversely, several factors can negatively influence the trial balance agreement, resulting in an imbalance. Identifying these factors is key to troubleshooting and correcting errors.

1. Transposition Errors: A Common Pitfall

Transposition errors are common data entry mistakes where digits are swapped. For instance, entering $123 as $132 is a transposition error. These errors are subtle but can easily disrupt the trial balance. Careful data entry and verification procedures are crucial to prevent these types of mistakes.

2. Omission Errors: Missing Transactions

Omitting transactions entirely is another significant source of trial balance disagreement. A transaction might be overlooked during data entry, resulting in an unbalanced trial balance. Regular review of source documents and cross-checking with supporting documentation helps prevent omission errors.

3. Incorrect Account Classification: Misplacing Transactions

Incorrectly classifying transactions is a frequent error. For example, posting a purchase of office supplies to the equipment account will cause an imbalance. A clear and well-defined chart of accounts is essential to prevent this type of error. Proper training of accounting personnel is also crucial.

4. Errors in Posting: Mistakes in Debits and Credits

Errors in posting debit and credit entries are commonplace. This could involve posting the wrong amount, to the wrong account, or even omitting the entry altogether. Double-checking each entry and utilizing accounting software's built-in error-checking features are critical for minimizing such errors.

5. Errors in Calculations: Miscalculations of Totals

Errors in calculations can also lead to a trial balance disagreement. This could involve incorrect addition, subtraction, multiplication, or division. Using calculators and spreadsheets with double-checking capabilities helps prevent this type of error.

6. Accounting for Accruals and Deferrals: Timing Issues

Accruals and deferrals, which are crucial accounting concepts, can create temporary imbalances if not handled correctly. Accrued expenses or revenues (expenses or revenues incurred but not yet paid or received) and deferred expenses or revenues (expenses or revenues paid or received in advance) require careful timing and accurate calculations to avoid impacting the trial balance's agreement. A thorough understanding of these concepts is necessary for accurate financial reporting.

7. Impact of Adjusting Entries: Year-End Adjustments

Adjusting entries, typically made at the end of an accounting period, are designed to update accounts for accruals, deferrals, and other adjustments. Incorrectly preparing or posting these adjusting entries can directly affect the trial balance's agreement. Careful planning and execution of the year-end closing process are crucial.

8. Errors Related to Inventory Valuation: Impact on Cost of Goods Sold

Errors in inventory valuation, whether it's using FIFO, LIFO, or weighted-average cost method, can directly influence the cost of goods sold (COGS) and therefore affect the trial balance. Inconsistencies in applying the chosen method or errors in calculating the cost of goods sold can lead to imbalances. Proper training and adherence to the selected inventory valuation method are essential.

9. Errors Related to Depreciation: Impact on Asset Values

Similarly, errors in calculating depreciation expense can influence the trial balance. Incorrect depreciation methods, rates, or useful lives can lead to discrepancies. Thorough understanding of depreciation principles and consistent application are crucial for accurate financial reporting.

10. Impact of Foreign Currency Transactions: Exchange Rate Fluctuations

For businesses engaging in international transactions, fluctuations in exchange rates can significantly impact the trial balance. If the exchange rate is not accurately recorded, the amounts in foreign currency accounts will be incorrectly translated to the reporting currency, leading to an imbalance. Careful monitoring and accurate conversion of foreign currencies are vital.

Troubleshooting a Trial Balance Disagreement

When a trial balance disagrees, systematic troubleshooting is essential. Here's a structured approach:

- Verify the accuracy of individual entries: Check each transaction for accuracy in accounts, amounts, and debits/credits.

- Review the general ledger: Look for any obvious errors or inconsistencies in the postings.

- Reconcile all relevant accounts: Perform bank reconciliations, accounts receivable reconciliations, and accounts payable reconciliations.

- Prepare a worksheet: A worksheet can help identify the amount of the imbalance and pinpoint potential error locations.

- Check for transposition, omission, and other common errors: Carefully review for these common mistakes.

- Review adjusting entries: Ensure all adjusting entries are accurate and properly posted.

- Seek assistance: If the problem persists, consult with an experienced accountant or auditor.

Conclusion: Maintaining Trial Balance Agreement

Maintaining a trial balance agreement is a critical aspect of sound financial management. By understanding the factors that influence its agreement, both positive and negative, businesses can improve the accuracy of their financial records, enhance the reliability of financial statements, and strengthen their overall financial health. Proactive measures, including meticulous data entry, consistent application of accounting principles, regular reconciliation of accounts, and effective internal controls, are fundamental for preventing discrepancies and ensuring the trial balance remains consistently in agreement. Regular training and ongoing review of accounting procedures are equally vital to maintain accuracy and prevent costly errors.

Latest Posts

Latest Posts

-

Scanner Is Input Device Or Output Device

Mar 26, 2025

-

Is The Absolute Value Of A Number Always Positive

Mar 26, 2025

-

Lowest Common Multiple Of 3 And 5

Mar 26, 2025

-

How Many Edges Does A Rectangular Prism Has

Mar 26, 2025

-

What Is The Least Common Multiple Of 20 And 8

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Which Items Influence The Trial Balance Agreement . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.