What Is The Meaning Of Statutory Liquidity Ratio

Juapaving

Mar 31, 2025 · 6 min read

Table of Contents

What is the Meaning of Statutory Liquidity Ratio (SLR)? A Deep Dive into its Implications

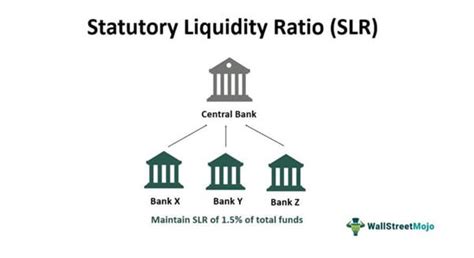

The Statutory Liquidity Ratio (SLR) is a crucial monetary policy tool employed by central banks globally, though its specifics vary by country. Understanding its meaning and implications is vital for anyone involved in finance, economics, or investing. This comprehensive guide delves into the intricacies of SLR, exploring its purpose, calculation, impact on the economy, and its relationship with other monetary policy instruments.

Defining the Statutory Liquidity Ratio (SLR)

The Statutory Liquidity Ratio (SLR) is the minimum percentage of a bank's total deposits that it is required by law to maintain in the form of liquid assets. These liquid assets are readily convertible into cash and include:

- Government Securities: These are bonds issued by the government, considered highly secure and liquid.

- Cash: Physical currency held by the bank.

- Gold: While less common now, some jurisdictions still permit gold as a component of SLR.

- Approved Securities: Other securities deemed acceptable by the central bank, often with low risk profiles.

Essentially, SLR acts as a reserve requirement, ensuring banks maintain sufficient liquidity to meet immediate obligations and prevent a liquidity crisis. This requirement helps stabilize the banking system and fosters confidence in the financial markets.

The Purpose of SLR

The primary objectives of imposing an SLR are:

- Maintaining Liquidity: The most fundamental purpose is to ensure banks possess sufficient readily available funds to meet the demands of depositors and other creditors. This prevents bank runs and systemic failures.

- Controlling Inflation: By limiting the amount of money banks can lend, SLR indirectly curbs money supply growth, thereby helping to control inflation. Less money circulating in the economy leads to lower demand-pull inflation.

- Supporting Government Borrowing: A significant portion of SLR assets are typically government securities. This provides the government with a reliable source of funding for its fiscal operations.

- Promoting Financial Stability: A healthy SLR helps maintain the stability of the financial system by reducing the risk of bank failures and preventing cascading effects across the banking sector. This contributes to overall macroeconomic stability.

- Directing Credit: The types of securities that qualify for SLR can be strategically influenced by the central bank to encourage investment in particular sectors or industries.

How is SLR Calculated?

The calculation of SLR is relatively straightforward:

SLR = (Liquid Assets / Total Deposits) x 100

Where:

- Liquid Assets: The value of all assets considered eligible for meeting the SLR requirement (as listed above).

- Total Deposits: The sum of all deposits held by the bank, including demand deposits, savings deposits, and time deposits.

The central bank sets the SLR percentage, and banks must maintain this minimum ratio at all times. Failure to comply can result in penalties, including fines and restrictions on lending activities.

Impact of SLR on the Economy

Changes in the SLR have significant repercussions on the economy:

- Impact on Money Supply: An increase in SLR reduces the amount of money banks can lend, contracting the money supply. This can curb inflation but may also slow down economic growth. Conversely, a decrease in SLR expands the money supply, potentially stimulating economic growth but also risking higher inflation.

- Impact on Interest Rates: Changes in SLR influence interest rates. A higher SLR typically leads to higher interest rates as banks have less money to lend, increasing the cost of borrowing. Conversely, a lower SLR tends to reduce interest rates.

- Impact on Investment: The availability of credit is directly affected by SLR. A restrictive SLR can hinder investment and economic expansion, while a more lenient SLR can encourage investment and boost economic activity.

- Impact on Government Borrowing Costs: Since a large portion of SLR assets are government securities, changes in SLR can affect the government's borrowing costs. Higher SLR can make it easier for the government to borrow at lower rates, while a lower SLR might increase borrowing costs.

SLR vs. Cash Reserve Ratio (CRR)

SLR is often confused with the Cash Reserve Ratio (CRR), another crucial monetary policy tool. While both aim to maintain financial stability, they differ significantly:

- SLR: Focuses on maintaining overall liquidity by holding a specified percentage of deposits in various liquid assets.

- CRR: Focuses specifically on maintaining a certain percentage of deposits in the form of cash with the central bank.

CRR is a more direct control on the money supply, as it directly reduces the amount of money banks can lend. SLR, while also influencing the money supply, is less direct and allows for more flexibility in the type of assets held as reserves. Both tools are often used in conjunction to achieve optimal monetary policy outcomes.

Factors Influencing SLR Changes

Central banks consider several factors before adjusting the SLR:

- Inflation Rate: High inflation typically prompts an increase in SLR to curb money supply growth.

- Economic Growth: Slow economic growth might lead to a reduction in SLR to stimulate lending and investment.

- External Debt: High levels of external debt might necessitate a higher SLR to ensure sufficient liquidity to service the debt.

- Foreign Exchange Reserves: Strong foreign exchange reserves provide a buffer, potentially allowing for a lower SLR.

- Global Economic Conditions: Global economic uncertainty can influence the central bank's decision to adjust SLR to protect the domestic economy.

Criticisms of SLR

While SLR plays a crucial role in maintaining financial stability, it's not without its limitations and criticisms:

- Reduced Lending Capacity: A high SLR can restrict banks' lending capacity, hindering economic growth and investment.

- Inefficient Asset Allocation: Banks might be forced to hold less profitable government securities to meet SLR requirements, impacting their profitability.

- Limited Effectiveness: SLR's effectiveness can be diminished by sophisticated financial instruments and off-balance sheet activities, which can circumvent its intended impact.

- Complexity: Understanding and implementing SLR can be complex, especially for smaller banks with limited resources.

Conclusion: SLR's Ongoing Importance

Despite the criticisms, the Statutory Liquidity Ratio remains a vital tool in central banks' arsenals for managing liquidity, controlling inflation, and fostering financial stability. Understanding its meaning, purpose, and implications is crucial for navigating the complexities of the financial landscape. The interplay between SLR and other monetary policy instruments is dynamic and requires careful consideration by policymakers to achieve optimal economic outcomes. Continued monitoring of SLR and its effects is essential for informed decision-making in the ever-evolving world of finance.

Further Exploration: Country-Specific SLR Variations

It's crucial to understand that the specifics of SLR implementation differ significantly across countries. The eligible liquid assets, the calculation methodology, and the level of the required ratio vary depending on the country's unique economic and financial context. Researching the specific SLR regulations of a particular country is essential for a comprehensive understanding of its impact on that economy. This involves exploring the policies of the respective central banks and their official publications.

This detailed analysis provides a comprehensive understanding of the Statutory Liquidity Ratio, its purpose, calculations, and impacts on the economy. The intricacies of SLR, its relationship to other monetary policy tools, and its country-specific variations showcase the complexity of maintaining financial stability and promoting sustainable economic growth. Understanding these aspects is critical for investors, economists, and policymakers alike.

Latest Posts

Latest Posts

-

What Are The Factors Of 94

Apr 01, 2025

-

Can You Have A Negative Acceleration

Apr 01, 2025

-

What Is The Square Root 69

Apr 01, 2025

-

Difference Between Communicable And Non Communicable Disease

Apr 01, 2025

-

How To Increase The Strength Of A Magnetic Field

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about What Is The Meaning Of Statutory Liquidity Ratio . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.