What Is An Office Of Profit

Juapaving

Mar 21, 2025 · 6 min read

Table of Contents

What is an Office of Profit? A Comprehensive Guide

Holding public office is a significant responsibility, demanding integrity, impartiality, and a commitment to serving the public interest. A key aspect of maintaining this integrity revolves around the concept of an "office of profit," a term that often sparks confusion and debate. This article delves deep into the intricacies of what constitutes an office of profit, exploring its implications, legal frameworks, and ongoing controversies.

Defining "Office of Profit": A Multifaceted Concept

At its core, an office of profit refers to a position that offers financial remuneration or other material benefits derived from the government or a public authority. It's a crucial concept in ensuring that elected representatives and public officials prioritize public service over personal gain. However, the precise definition remains nuanced and often contested, varying across jurisdictions and legal interpretations.

Several key elements contribute to defining an office of profit:

-

Remuneration: This is arguably the most straightforward element. Any position that provides a salary, allowance, perks, or other financial compensation directly from public funds or linked to government functions typically falls under this category. This includes regular salaries, honorariums, travel allowances, and even benefits like subsidized housing or medical insurance.

-

Governmental or Public Authority Connection: The source of the benefit is paramount. The office must be linked to a governmental body, a public authority, or an entity significantly influenced by or dependent on government funds. A privately funded position, even one with substantial financial rewards, wouldn't usually be classified as an office of profit under this understanding.

-

Nature of Duties: The nature of the duties performed within the position is also a crucial factor. If the duties are directly related to the functioning of the government or public authority, the likelihood of it being classified as an office of profit increases. The degree of control exercised over public resources or influence on government policy is often taken into account.

Distinguishing Offices of Profit from Other Positions: A Delicate Balance

The line between an office of profit and other positions, like voluntary roles or advisory boards, can often be blurry. Several factors help distinguish them:

-

Level of Authority: Offices of profit usually involve a degree of official authority, responsibility, and decision-making power within the government or public sphere. This contrasts with advisory roles, which might offer compensation but lack significant power or control over public affairs.

-

Dependency on Government Funding: A key differentiator is the level of reliance on government funding. While many positions might receive some government grants or funding, offices of profit are characterized by a direct and substantial dependence on public resources for their existence and operation.

-

Public Accountability: Offices of profit inherently carry a higher level of public accountability. Those holding such offices are subject to greater scrutiny and oversight, including potential conflicts-of-interest regulations and restrictions on outside employment.

The Legal Framework and Constitutional Provisions

The legal framework surrounding offices of profit varies considerably across different countries. Many countries incorporate specific provisions in their constitutions or statutes to regulate these positions. These provisions often aim to prevent conflicts of interest, maintain the integrity of the government, and uphold the principles of good governance.

Examples from Different Jurisdictions:

-

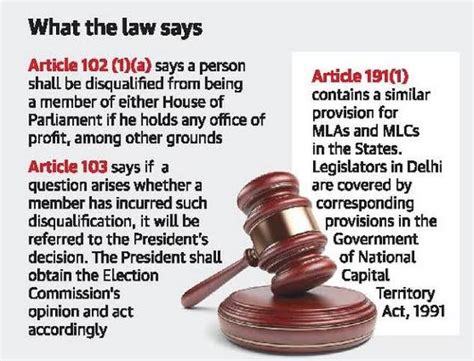

India: The Indian Constitution prohibits Members of Parliament (MPs) and Members of the Legislative Assemblies (MLAs) from holding any "office of profit under the Government of India," or any state government. The interpretation and application of this provision have been the subject of much litigation and debate, often focusing on the precise definition of "office of profit."

-

United Kingdom: The UK doesn't have a constitutional prohibition against MPs holding offices of profit in the same way as India. However, several parliamentary rules and conventions aim to prevent conflicts of interest. The House of Commons' Committee of Privileges plays a significant role in investigating potential breaches.

-

United States: The US Constitution has provisions to prevent conflicts of interest, but the definition and enforcement of "office of profit" is less clearly defined than in some other countries. The focus is more on financial disclosure and ethical guidelines for officials.

Challenges and Controversies in Defining and Implementing Regulations

Despite well-intentioned laws and regulations, the practical application of "office of profit" rules poses many challenges:

-

Ambiguous Definitions: The lack of a precise, universally accepted definition often leads to conflicting interpretations and protracted legal battles. What constitutes "material benefit," "government connection," and "significant influence" often requires careful analysis on a case-by-case basis.

-

Loophole Exploitation: Clever legal maneuvering and the design of positions specifically to circumvent existing regulations represent a significant challenge. The ongoing debate around various roles and their classification highlights the vulnerability of such laws to exploitation.

-

Political Motivations: The application of "office of profit" rules can sometimes be influenced by political motivations. Disagreements over interpretations are often deeply entrenched along partisan lines, leading to lengthy legal disputes and delays in resolution.

-

Changing Nature of Governance: The increasing complexity of governance and the blurring of lines between the public and private sectors further complicate the application of these rules. The involvement of private entities in public projects and the growing influence of lobbying groups add further dimensions to this challenge.

Case Studies: High-Profile Examples of Office of Profit Disputes

Several high-profile cases worldwide illustrate the complexities and controversies associated with "office of profit" disputes:

Case Study 1 (Hypothetical): A prominent politician appointed to an advisory board receiving a substantial honorarium and having significant influence over government policy related to their expertise. The opposition parties argue this constitutes an office of profit and challenge the appointment's legitimacy. The courts would grapple with balancing the payment's nature, advisory role, and level of influence on policy decisions.

Case Study 2 (Hypothetical): A government agency creates a new position with seemingly limited responsibilities but offers a considerable salary and perks. The lack of clear delineation between genuine need for the position and a potential attempt to provide benefits to a favored individual would become a central element of the court's scrutiny.

Case Study 3 (Hypothetical): A member of the legislature appointed as the chairperson of a public sector undertaking, receiving remuneration and certain perks. The challenge would focus on evaluating the nature of the chairmanship and the decision-making power wielded. Does it represent effective involvement in government function and qualify as holding an office of profit?

The Importance of Transparency and Accountability

The debate surrounding offices of profit highlights the critical importance of transparency and accountability in governance. Robust legislative frameworks, clear definitions, and a commitment to impartial legal processes are essential. Moreover, strengthening mechanisms for oversight, investigations, and conflict-of-interest management are crucial to mitigating the risks associated with potential abuse. Public education on the concept of offices of profit, their implications, and related legal frameworks also plays a significant role in promoting ethical governance and responsible public service.

Conclusion: An Ongoing Struggle for Integrity

The concept of an office of profit remains a complex and evolving area of law and political discourse. While the underlying principle of preventing conflicts of interest and upholding the integrity of government is widely accepted, the application of this principle often presents substantial challenges. Continuous refinement of legal frameworks, improved enforcement mechanisms, and enhanced public awareness are crucial to ensure the effective implementation of regulations and maintain public trust in government institutions. The ongoing debate around offices of profit serves as a powerful reminder of the persistent need for vigilance, transparency, and a commitment to ethical governance.

Latest Posts

Latest Posts

-

How To Prove That Parallel Lines Mean Equal Alternate Angles

Mar 27, 2025

-

What Color Is A Animal Cell

Mar 27, 2025

-

What Is The Si Unit For Torque

Mar 27, 2025

-

How Many Liters Are In 7 Gallons

Mar 27, 2025

-

Why Does An Equation Need To Be Balanced

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about What Is An Office Of Profit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.