The Underlying Principle Of All Types Of Insurance Is

Juapaving

Mar 23, 2025 · 7 min read

Table of Contents

The Underlying Principle of All Types of Insurance Is Risk Transfer and Pooling

Insurance, in its myriad forms, from health and auto to life and homeowner's, might seem diverse. However, a single, fundamental principle underpins them all: risk transfer and pooling. This article will delve deep into this core concept, exploring how it operates across various insurance types, the key elements involved, and its significance in modern society. We'll also examine some of the nuances and complexities associated with this seemingly simple principle.

Understanding Risk Transfer

At its heart, insurance is a mechanism for transferring risk. Individuals and businesses face numerous potential risks – accidents, illnesses, theft, natural disasters – that could lead to significant financial losses. Instead of bearing this risk alone, they transfer it to an insurance company. In exchange for a regular payment (the premium), the insurer agrees to compensate the insured (the policyholder) for covered losses.

This transfer isn't simply a matter of shifting the burden; it's about managing uncertainty. The insured pays a relatively small, predictable amount (the premium) to avoid the potentially catastrophic cost of an unforeseen event. This predictability is crucial for financial planning and stability. Consider a homeowner facing the risk of a fire. The cost of rebuilding their home could be devastating. By transferring that risk to an insurer, they gain peace of mind, knowing that they'll be financially protected in the event of such a disaster.

Types of Risk Transferred:

-

Pure Risk: Insurance primarily deals with pure risk, which involves the possibility of loss but no possibility of gain. This contrasts with speculative risk (e.g., investing in the stock market) where there's a chance of both profit and loss. Insurance only covers pure risks because the purpose is to mitigate potential losses, not to participate in speculative ventures.

-

Financial Risk: The risks transferred are primarily financial. While insurance might cover physical damage or injury, the core concern is the financial impact of such events. The insurer compensates the policyholder for the monetary value of the loss, restoring them to their previous financial position (as far as possible within the policy's limits).

-

Specific vs. General Risks: Insurance policies can cover specific risks (e.g., fire damage to a specific building) or more general risks (e.g., liability for accidents). The specificity of coverage influences the premium and the extent of the insurer’s responsibility.

The Power of Pooling: Spreading the Risk

Risk transfer alone wouldn't be effective or sustainable. This is where the concept of pooling comes into play. Insurance companies don't simply absorb the risks of individual policyholders; they pool them together. By collecting premiums from a large number of individuals or businesses, the insurer creates a fund from which they can pay out claims. This process works based on the principle of the law of large numbers.

The Law of Large Numbers and Predictive Modeling:

The law of large numbers states that as the number of independent events increases, the average outcome becomes more predictable. Insurance companies leverage this law to predict the frequency and severity of claims. They use sophisticated statistical models and historical data to estimate the probability of various events and their associated costs. This enables them to set premiums that are actuarially sound, ensuring the pool of funds is sufficient to cover expected claims while maintaining profitability.

Diversification and Reduced Volatility:

Pooling provides diversification, spreading the risk across a large number of policyholders. This reduces the impact of individual events. If one policyholder suffers a significant loss, the impact on the insurer is minimized because the loss is absorbed by the entire pool. This is crucial for maintaining financial stability for the insurer and ensuring the ability to pay out claims consistently. Without pooling, the risk for individual insurers would be exponentially greater.

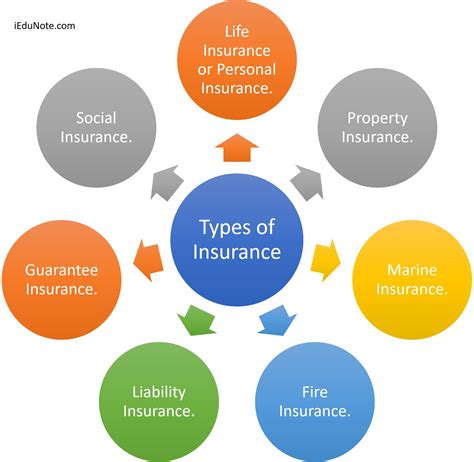

Different Types of Insurance and the Underlying Principle

The principle of risk transfer and pooling applies across the entire spectrum of insurance products. Here are some examples:

1. Health Insurance:

Health insurance protects individuals from the potentially crippling costs of medical treatment. Policyholders pay premiums, and the insurer covers medical expenses, such as hospital stays, doctor visits, and medications. The risk here is the unpredictable and potentially high cost of illness or injury. Pooling allows the insurer to manage this risk by spreading the cost across a large pool of policyholders.

2. Auto Insurance:

Auto insurance covers losses arising from car accidents. This includes damage to the insured vehicle, injuries to the driver or passengers, and liability for damages caused to others. The risks are accidents, theft, and other vehicle-related incidents. The insurer pools premiums to cover the costs of repairing vehicles, paying medical bills, and settling legal claims.

3. Homeowners Insurance:

Homeowners insurance protects against losses related to property damage, such as fire, theft, or weather-related damage. It also typically includes liability coverage for injuries sustained on the property. The risk is the substantial cost of repairing or rebuilding a home and covering liability claims. The insurance company pools premiums to cover the cost of these potential losses.

4. Life Insurance:

Life insurance provides a financial safety net for beneficiaries in the event of the insured's death. It allows policyholders to transfer the risk of financial hardship to their families after their passing. The risk is the loss of income and financial support. The insurance company pools premiums to pay out death benefits to beneficiaries when claims are filed.

5. Business Insurance:

Businesses face a wide range of risks, including property damage, liability claims, and business interruption. Business insurance covers these risks, allowing businesses to continue operating even after a significant loss. The principle of risk transfer and pooling works the same way: businesses pay premiums, the insurer pools the funds and covers losses according to the terms of the policy.

The Importance of Accurate Risk Assessment

The success of the risk transfer and pooling model hinges on accurate risk assessment. Insurance companies employ actuaries and other specialists to analyze data, predict future claims, and set premiums accordingly. This process involves considering various factors, including the age, health, occupation, and location of policyholders, along with the specific risks covered by the policy.

An inaccurate risk assessment can lead to several negative outcomes:

- Underpricing: Premiums set too low can lead to insufficient funds to cover claims, putting the insurer at risk of insolvency.

- Overpricing: Premiums set too high can make insurance unaffordable, reducing demand and impacting the insurer's profitability.

- Adverse Selection: This occurs when individuals with a higher-than-average risk of loss are more likely to purchase insurance, skewing the risk pool and potentially leading to higher claims payouts.

To mitigate these risks, insurers employ various strategies, such as underwriting (carefully assessing applicants to determine their risk profile), risk management techniques, and sophisticated pricing models. They constantly refine their risk assessment methods using advanced data analytics and machine learning.

The Role of Regulation and Consumer Protection

Insurance is a heavily regulated industry. Government oversight is crucial to ensure that insurers are financially stable, act fairly, and protect consumers' interests. Regulations often include requirements for minimum capital reserves, solvency testing, and consumer protection measures. These regulations are designed to protect policyholders from fraudulent insurers and to ensure that the insurance market operates fairly and transparently.

Conclusion: A Cornerstone of Modern Society

The principle of risk transfer and pooling is more than just a theoretical framework; it's a fundamental cornerstone of modern society. Insurance provides individuals and businesses with financial security, enabling them to manage risks and plan for the future with confidence. While complexities exist, from actuarial science to regulatory compliance, the underlying principle remains consistent: sharing the burden of unpredictable loss through a collaborative pooling system, ensuring financial stability and enabling individuals and businesses to thrive in the face of uncertainty. Understanding this fundamental principle is key to understanding the vital role insurance plays in our world.

Latest Posts

Latest Posts

-

Common Factors Of 15 And 20

Mar 24, 2025

-

How Many Sides In A Rectangle

Mar 24, 2025

-

Least Common Multiple Of 36 And 42

Mar 24, 2025

-

Dissolving Sugar In Water Is Which Change

Mar 24, 2025

-

Define The Following Terms Alleles Genotype Phenotype Genome

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about The Underlying Principle Of All Types Of Insurance Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.