Which Of The Following Is True About The Real Gdp

Juapaving

Mar 16, 2025 · 5 min read

Table of Contents

Decoding Real GDP: Separating Fact from Fiction

Understanding Real GDP is crucial for comprehending economic health and growth. Often confused with nominal GDP, it provides a more accurate picture of a nation's economic performance by accounting for inflation. But what exactly is true about Real GDP? Let's delve into the complexities and dispel some common misconceptions.

What is Real GDP?

Real GDP (Gross Domestic Product) measures the total value of all final goods and services produced within a country's borders in a specific period, typically a year or a quarter. Crucially, it's adjusted for inflation. This adjustment is vital because nominal GDP, which isn't adjusted for inflation, can be misleading. If prices rise significantly, nominal GDP will increase even if the actual quantity of goods and services produced remains the same or even decreases.

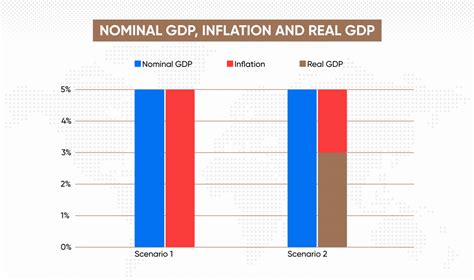

Nominal GDP vs. Real GDP: The Key Difference

The fundamental difference lies in how they handle price changes. Nominal GDP uses current market prices, reflecting the actual monetary value of goods and services. Real GDP, on the other hand, uses constant prices from a base year. This base year serves as a benchmark to isolate the impact of changes in the quantity of goods and services produced from the effects of inflation.

Calculating Real GDP: A Simplified Look

Calculating real GDP involves a process called deflating nominal GDP. This is usually done using a price index, such as the Consumer Price Index (CPI) or the GDP deflator. The formula is relatively straightforward:

Real GDP = (Nominal GDP / Price Index) x 100

The price index is typically expressed as a percentage or an index number. For instance, if the price index is 110, it implies a 10% increase in prices compared to the base year. Dividing the nominal GDP by the price index adjusts for this inflation, giving us a more accurate measure of real economic output.

Common Misconceptions about Real GDP

Several misconceptions surround Real GDP, leading to flawed economic interpretations. Let's address some of the most prevalent ones:

Myth 1: Real GDP Perfectly Captures Economic Well-being

While Real GDP provides a valuable indicator of economic output, it's not a perfect measure of overall societal well-being. Several crucial factors are excluded:

- Income Inequality: A high Real GDP doesn't necessarily imply equitable income distribution. A nation can boast a high Real GDP while experiencing significant wealth disparity.

- Environmental Impact: Real GDP doesn't account for environmental degradation. Economic activities might boost Real GDP while simultaneously harming the environment, leading to unsustainable growth.

- Non-Market Activities: Real GDP only considers market transactions. It excludes unpaid work, such as household chores or volunteer work, which contribute significantly to societal well-being.

- Quality of Life: Factors like health, education, leisure time, and social connections aren't captured by Real GDP. A nation might have a high Real GDP but suffer from poor health outcomes or low levels of social cohesion.

Therefore, it's crucial to remember that Real GDP is just one piece of the puzzle when assessing a nation's overall progress and well-being.

Myth 2: A Rising Real GDP Always Signals a Thriving Economy

A consistently rising Real GDP generally indicates economic expansion. However, the rate of growth and its distribution are equally important. A slow but steady increase might signify stability, while a rapid but unsustainable surge could indicate an impending economic bubble.

Furthermore, a rising Real GDP doesn't guarantee an improvement in living standards for all citizens. As discussed earlier, income inequality and environmental degradation can negate the positive impacts of growth.

Sustainable and Inclusive Growth: The focus should shift from simply increasing Real GDP to achieving sustainable and inclusive growth that benefits all segments of society while preserving the environment.

Myth 3: Real GDP is the Sole Determinant of Policy Decisions

While Real GDP is an essential economic indicator, policymakers shouldn't rely solely on it when making decisions. A holistic approach is necessary, considering factors like inflation, employment rates, income distribution, environmental sustainability, and social well-being. Overemphasis on Real GDP growth can lead to neglecting other critical aspects of economic and social development.

Other Crucial Economic Indicators: Governments and economists use numerous indicators beyond Real GDP to make informed policy decisions. These include inflation rates (CPI, PPI), unemployment rates, consumer confidence indices, industrial production indices, and various measures of social well-being.

Myth 4: Real GDP Accurately Reflects Underground Economy

The underground economy, consisting of untaxed and unregulated transactions, isn't fully captured by Real GDP. This sector can represent a significant portion of a nation's economic activity, especially in developing countries. The omission of this substantial economic activity leads to an underestimation of the actual overall economic output.

Challenges in Measuring the Underground Economy: Accurately measuring the size of the underground economy is notoriously difficult due to its clandestine nature. Economists employ various indirect methods, but these estimates remain prone to significant uncertainties.

Myth 5: Real GDP is a Perfect Predictor of Future Economic Performance

Real GDP is a measure of past performance. While trends in Real GDP can provide insights into potential future economic activity, it's not a perfect predictor. Unforeseen events, such as economic shocks, natural disasters, or geopolitical instability, can significantly impact future economic growth.

Limitations of Predictive Power: Economists employ various forecasting techniques, including econometric models, to predict future Real GDP growth. However, these predictions are subject to uncertainties and margin of errors. Real-world events often deviate from theoretical models, limiting the accuracy of forecasts.

Real GDP: A Powerful Tool, but Not a Panacea

In conclusion, Real GDP serves as a valuable tool for assessing economic performance. It provides a clearer picture of a nation's economic output than nominal GDP by adjusting for inflation. However, it's crucial to recognize its limitations and avoid misinterpretations. Real GDP shouldn't be the sole indicator used to assess economic well-being, policy decisions, or future economic prospects. A comprehensive analysis that incorporates multiple indicators and considers broader societal factors is essential for understanding the true state of an economy and guiding effective policymaking. Understanding these nuances is crucial for responsible economic analysis and informed decision-making. The true value of Real GDP lies in its use as one component of a broader economic assessment, not as a standalone metric for judging national success.

Latest Posts

Latest Posts

-

One Hundred Thousand Dollars In Numbers

Mar 16, 2025

-

Is Silicon A Metal Or Nonmetal Or Metalloid

Mar 16, 2025

-

Interior Angle Of A 12 Sided Polygon

Mar 16, 2025

-

Is Melting Butter A Chemical Or Physical Change

Mar 16, 2025

-

What Are Raw Materials Needed For Photosynthesis

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is True About The Real Gdp . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.