Which Of The Following Is An Advantage Of Sole Proprietorship

Juapaving

Mar 09, 2025 · 7 min read

Table of Contents

Which of the Following is an Advantage of Sole Proprietorship? A Deep Dive into the Benefits of Solo Entrepreneurship

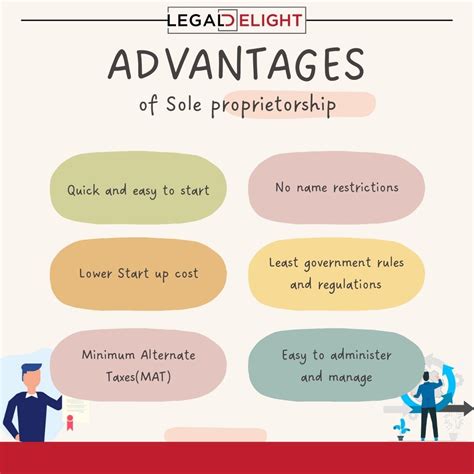

Choosing the right business structure is crucial for any entrepreneur. While corporations and partnerships offer certain advantages, the sole proprietorship remains a popular choice, especially for startups and small businesses. But what exactly makes it so attractive? This comprehensive guide delves deep into the advantages of a sole proprietorship, highlighting why it's a compelling option for many.

Simplicity and Ease of Setup: The Undeniable Appeal of Going Solo

One of the most significant advantages of a sole proprietorship is its unparalleled simplicity. Setting up a sole proprietorship is typically far less complex and time-consuming than establishing a corporation or partnership. There's minimal paperwork involved, and the regulatory hurdles are significantly lower. This ease of setup allows entrepreneurs to focus their energy and resources on building their business, rather than navigating bureaucratic processes. This streamlined process translates to faster startup times, a critical factor in today's competitive market.

Minimal Legal Formalities: A Streamlined Beginning

Unlike corporations, which require articles of incorporation and bylaws, a sole proprietorship generally needs little more than a business license and potentially a registered business name (DBA). This reduction in legal complexities minimizes the initial financial investment and the time commitment required to launch the business. The simplified process empowers individuals with entrepreneurial aspirations to quickly translate their ideas into reality.

Direct Control and Decision-Making: The Power of Autonomy

In a sole proprietorship, the owner maintains complete control over all aspects of the business. There's no need to consult partners or shareholders, allowing for swift decision-making and increased agility. This autonomy extends to every aspect of operations, from product development and marketing strategies to financial management and hiring decisions. This unfettered authority enables quicker responses to market changes and opportunities, giving the sole proprietor a competitive edge.

Direct Ownership and Profit Retention: Keeping the Rewards

One of the most attractive aspects of a sole proprietorship is the direct link between effort and reward. All profits generated belong entirely to the owner. There's no need to share profits with partners or distribute dividends to shareholders. This direct ownership fosters a strong sense of ownership and incentivizes the owner to maximize the business's profitability. This unadulterated profit retention provides the owner with greater financial flexibility and control over their earnings.

Tax Advantages: Keeping More of Your Hard-Earned Money

The tax benefits associated with sole proprietorships are another compelling advantage. The business isn't taxed separately from the owner; instead, profits and losses are reported on the owner's personal income tax return as Schedule C. This pass-through taxation simplifies the tax process significantly, eliminating the complexities of corporate tax filings.

Simplified Tax Filing: Less Administrative Burden

This simplified tax structure reduces the administrative burden on the business owner, saving both time and money. There's no need to maintain separate business bank accounts or deal with the complexities of corporate tax returns. This streamlined tax process allows the owner to focus more on business operations and less on tax compliance.

Potential for Lower Tax Liability: Strategic Planning Opportunities

While the tax rate depends on the owner's individual income, the pass-through taxation can, in some instances, result in a lower overall tax liability compared to other business structures. Strategic tax planning, such as utilizing deductions and credits, can further optimize the tax burden for sole proprietors. This potential for tax optimization adds another layer of financial benefit to this business structure.

Flexibility and Adaptability: Responding to the Market's Demands

Sole proprietorships offer unparalleled flexibility and adaptability. The owner can quickly respond to market changes, implement new strategies, and adjust their business operations without needing the approval of others. This agility is crucial in dynamic markets where swift action can be the difference between success and failure.

Quick Decision-Making: Agility in a Changing Marketplace

The ability to make decisions swiftly and independently is a defining characteristic of sole proprietorships. This enhanced agility enables entrepreneurs to capitalize on emerging opportunities, adapt to shifting market demands, and proactively address challenges. This responsiveness is a significant advantage in today's fast-paced business environment.

Easy Modification of Operations: Adapting to New Circumstances

Adapting the business operations to changing circumstances is significantly easier in a sole proprietorship. The owner has the sole authority to change business hours, product lines, or service offerings, without needing the consent of partners or shareholders. This operational flexibility is essential for growth and survival in a competitive landscape.

Privacy and Confidentiality: Protecting Your Business Information

A significant advantage of sole proprietorships, often overlooked, is the enhanced level of privacy and confidentiality. Unlike corporations, the financial details and operational strategies of a sole proprietorship are not subject to public disclosure. This privacy protects the owner's sensitive information and intellectual property, offering a layer of security not always present in other business structures.

Limited Public Disclosure: Protecting Sensitive Information

The less stringent reporting requirements for sole proprietorships offer a level of confidentiality that is appealing to entrepreneurs who wish to keep their business strategies and financial performance private. This enhanced privacy fosters a sense of security and control over sensitive business information.

Easier to Liquidate or Dissolve: Streamlined Exit Strategy

When it's time to close the business, the process is significantly simpler in a sole proprietorship. There are fewer legal and regulatory hurdles compared to other business structures. This ease of liquidation offers a smooth exit strategy for entrepreneurs who decide to wind down their operations.

Streamlined Closure Process: Minimizing Complexity

The straightforward nature of dissolving a sole proprietorship minimizes legal and administrative complexities, allowing owners to focus on transitioning out of the business rather than dealing with extensive paperwork and bureaucratic processes. This streamlined exit strategy offers entrepreneurs peace of mind.

Disadvantages to Consider: Balancing the Pros and Cons

While sole proprietorships offer numerous advantages, it's crucial to acknowledge their limitations. The unlimited liability is a significant drawback. The owner's personal assets are at risk if the business incurs debts or faces legal action. Furthermore, raising capital can be challenging, as securing loans or attracting investors may be more difficult compared to larger business entities. Additionally, growth potential may be limited due to the reliance on a single individual's resources and capabilities. It's essential to weigh these disadvantages against the advantages to determine if a sole proprietorship is the right structure for your specific circumstances.

Understanding Unlimited Liability: Protecting Your Personal Assets

The absence of a legal separation between the business and the owner means personal assets are at risk if the business incurs debt or faces lawsuits. Understanding this unlimited liability and implementing strategies to mitigate risk is crucial for any aspiring sole proprietor. This might involve purchasing liability insurance or maintaining a strong financial cushion.

Capital Acquisition Challenges: Navigating Funding Limitations

Securing funding for growth and expansion can be more challenging for sole proprietorships compared to other structures. Banks and investors may be hesitant to lend significant amounts to businesses with limited liability protection. Exploring alternative funding options like bootstrapping, crowdfunding, or small business loans is crucial for managing financial resources effectively.

Growth Limitations: Scaling Challenges

The reliance on a single individual's efforts and resources can limit the growth potential of a sole proprietorship. The capacity for rapid expansion may be constrained by the owner's time, skills, and available capital. This can be a significant factor for businesses with ambitious growth targets.

Conclusion: The Right Choice for the Right Entrepreneur

The advantages of a sole proprietorship are undeniable, particularly for entrepreneurs seeking simplicity, control, and direct profit retention. The ease of setup, pass-through taxation, and flexibility make it an attractive option for many individuals starting their entrepreneurial journey. However, understanding the limitations, especially the unlimited liability, is vital. By carefully weighing the pros and cons and understanding the implications of this business structure, entrepreneurs can make informed decisions about the optimal structure for their business goals and personal circumstances. Choosing the right business structure is a critical decision that will influence the success and longevity of your business. A thorough understanding of the specific advantages and disadvantages of a sole proprietorship is crucial to making an informed and confident choice.

Latest Posts

Latest Posts

-

What Is The Unit Of Inertia

Mar 09, 2025

-

The Correct Name For The Compound N2o3 Is

Mar 09, 2025

-

Which Of The Following Is A Function Of The Nucleus

Mar 09, 2025

-

What Is The Roman Numeral For 59

Mar 09, 2025

-

What Are Three Types Of Ecological Pyramids

Mar 09, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is An Advantage Of Sole Proprietorship . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.