The Demand Curve For A Perfectly Competitive Market Is

Juapaving

Mar 22, 2025 · 6 min read

Table of Contents

The Demand Curve for a Perfectly Competitive Market: A Deep Dive

The demand curve for a perfectly competitive market is a fundamental concept in economics, representing the relationship between the price of a good and the quantity demanded by consumers. Understanding this curve is crucial for grasping how perfectly competitive markets function and how prices are determined. Unlike other market structures, the demand curve facing a single firm in perfect competition differs significantly from the market demand curve. This article will explore the characteristics of this demand curve, its implications for firm behavior, and the factors that can influence its shape.

Defining Perfect Competition

Before delving into the demand curve, it's essential to define the characteristics of a perfectly competitive market:

-

Numerous Buyers and Sellers: A large number of buyers and sellers participate in the market, ensuring that no single entity can influence the market price. Each participant is a "price taker," meaning they must accept the prevailing market price.

-

Homogeneous Products: The goods or services offered are identical or nearly identical, making them perfect substitutes for one another. Consumers see no difference between products from different sellers.

-

Free Entry and Exit: There are no significant barriers to entry or exit from the market. Firms can easily enter if they see profit opportunities and exit if they are unprofitable.

-

Perfect Information: Buyers and sellers have complete and accurate information about prices, product quality, and other market conditions. There's no information asymmetry.

-

No Externalities: The production or consumption of the good doesn't affect third parties. There are no spillover costs or benefits.

The Market Demand Curve vs. The Firm's Demand Curve

It's crucial to differentiate between the market demand curve and the demand curve faced by an individual firm in a perfectly competitive market.

The Market Demand Curve

The market demand curve represents the total quantity of a good demanded by all consumers at various price levels. It's downward-sloping, reflecting the law of demand: as the price of a good decreases, the quantity demanded increases (ceteris paribus). This curve is determined by factors like consumer preferences, income levels, and the prices of related goods.

The Firm's Demand Curve

The demand curve facing an individual firm in perfect competition is perfectly elastic, or horizontal. This means that the firm can sell any quantity of the good at the prevailing market price, but it cannot sell anything above that price. The firm is a price taker; it has no power to influence the market price. If a firm attempts to charge a higher price than the market price, consumers will simply buy from other firms offering the same product at a lower price. Conversely, there is no incentive to lower the price since the firm can sell all it wants at the market price.

Graphical Representation

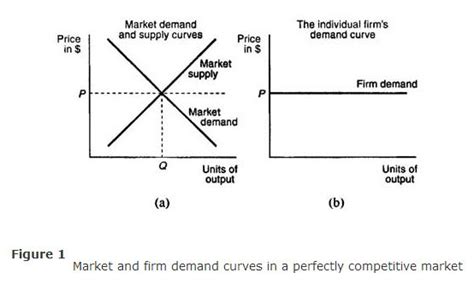

The difference between the market demand curve and the firm's demand curve can be illustrated graphically:

(Insert a graph here showing a downward-sloping market demand curve and a horizontal firm demand curve at the market price.)

The market demand curve (D) shows the inverse relationship between price and quantity demanded in the entire market. The firm's demand curve (d) is a horizontal line at the market price (P*), indicating that the firm can sell any quantity at that price.

Implications for Firm Behavior

The perfectly elastic demand curve has significant implications for the behavior of firms in perfect competition:

-

Price Taker: Firms are price takers, meaning they have no control over the price they charge. They must accept the market price as given.

-

Output Decisions: A firm's main decision is how much to produce at the given market price to maximize profit. They will continue to produce as long as marginal revenue (MR) equals marginal cost (MC), which in perfect competition is also equal to the market price.

-

Zero Economic Profit in the Long Run: Due to free entry and exit, economic profits attract new firms into the market, increasing supply and pushing down the market price until economic profits are zero. Similarly, economic losses induce firms to leave the market, decreasing supply and raising the market price until economic losses are eliminated.

Factors Affecting the Firm's Demand Curve

While the firm's demand curve is typically horizontal in perfect competition, several factors can indirectly influence its position and the market price:

-

Changes in Market Demand: Shifts in the overall market demand curve (caused by factors like changes in consumer income, tastes, or prices of related goods) will affect the market price and, consequently, the position of the firm's horizontal demand curve. An increase in market demand will shift the firm's demand curve upward (to a higher price level), and a decrease will shift it downward.

-

Changes in Market Supply: Similarly, changes in market supply (due to factors like technological advancements, changes in input prices, or entry/exit of firms) will affect the market price and shift the firm's demand curve. An increase in market supply will shift the firm's demand curve downward, and a decrease will shift it upward.

-

Government Intervention: Government policies like taxes, subsidies, or price controls can directly affect the market price and hence the position of the firm's demand curve.

The Short Run vs. the Long Run

The analysis of the perfectly competitive market and its demand curve often distinguishes between the short run and the long run:

Short Run: In the short run, some factors of production are fixed, meaning firms cannot immediately adjust their scale of operation. Firms can still make a profit or a loss at the given market price.

Long Run: In the long run, all factors of production are variable, allowing firms to adjust their size and enter or exit the market freely. This leads to the zero economic profit condition mentioned earlier.

Conclusion

The demand curve for a perfectly competitive market is a fundamental concept that highlights the unique characteristics of this market structure. While the individual firm faces a perfectly elastic demand curve, meaning it is a price taker, the market demand curve reflects the overall consumer preferences and is downward sloping. Understanding this distinction is vital for comprehending firm behavior, market equilibrium, and the forces driving prices in a perfectly competitive environment. Factors affecting market demand and supply, and government interventions, play a crucial role in influencing the market price and indirectly affecting the firm's horizontal demand curve. The distinction between the short run and long run analysis further clarifies how firms adjust to market conditions in the pursuit of profit maximization and the eventual long-run equilibrium of zero economic profit. This knowledge is crucial not only for economic theory but also for understanding real-world markets that approach perfect competition, allowing businesses to strategize and make informed decisions within the framework of market forces.

Latest Posts

Latest Posts

-

Classify The Below Solids As Amorphous Or Crystalline

Mar 23, 2025

-

Every Rhombus Is A Parallelogram True Or False

Mar 23, 2025

-

Round 73 To The Nearest Ten

Mar 23, 2025

-

How Many Inches In 16 Cm

Mar 23, 2025

-

What Two Organelles Are Only Found In Plant Cells

Mar 23, 2025

Related Post

Thank you for visiting our website which covers about The Demand Curve For A Perfectly Competitive Market Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.