Resources Owned By A Business Are Referred To As

Juapaving

Mar 13, 2025 · 6 min read

Table of Contents

Resources Owned by a Business: A Deep Dive into Assets

Business success hinges on effectively managing its resources. Understanding what constitutes a business's resources, how they're categorized, and their impact on financial health is crucial for owners, managers, and investors alike. Resources owned by a business are formally referred to as assets. This comprehensive guide delves into the multifaceted world of business assets, exploring their various types, classifications, and significance in financial reporting and strategic decision-making.

Defining Business Assets: What They Are and Why They Matter

At its core, a business asset represents anything of value owned by a company that can be used to generate income, provide services, or contribute to its overall operational efficiency. These resources are essential for a business to operate, grow, and achieve its objectives. The value of these assets is reflected on a company's balance sheet, a crucial financial statement providing a snapshot of its financial position at a specific point in time.

The importance of understanding business assets cannot be overstated. They are fundamental to:

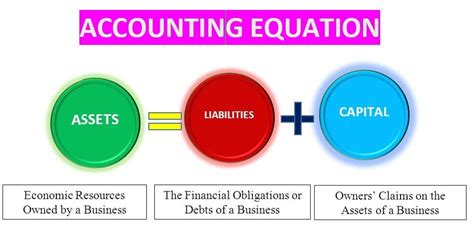

- Financial Reporting: Assets are a critical component of the accounting equation (Assets = Liabilities + Equity), forming the basis for accurate financial reporting and analysis.

- Creditworthiness: A company's asset base significantly influences its creditworthiness and ability to secure loans from financial institutions.

- Investment Decisions: Potential investors carefully analyze a company's assets to assess its potential for profitability and long-term growth.

- Strategic Planning: Understanding the composition and value of assets helps in strategic planning, facilitating informed decisions regarding investments, acquisitions, and resource allocation.

- Valuation: Determining the fair market value of a business involves a thorough assessment of its tangible and intangible assets.

Classifying Business Assets: A Comprehensive Overview

Business assets are broadly classified into two major categories: current assets and non-current (or long-term) assets. This classification is based on their liquidity, or how easily they can be converted into cash within a short period (typically one year).

Current Assets: The Liquid Lifeline

Current assets are resources expected to be converted into cash, sold, or consumed within one year or the operating cycle, whichever is longer. They represent the company's short-term financial strength and its ability to meet its immediate obligations. Key examples include:

- Cash and Cash Equivalents: This includes money readily available in bank accounts, petty cash, and highly liquid investments like treasury bills that can be quickly converted to cash. This is the most liquid of all assets.

- Accounts Receivable: This represents money owed to the business by customers for goods or services sold on credit. It's a vital component of the sales cycle, but its collection timeframe introduces a level of risk.

- Inventory: This encompasses raw materials, work-in-progress, and finished goods held by the business for sale. Inventory management is crucial to balancing supply and demand and minimizing storage costs. The valuation of inventory can be complex, using methods like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out).

- Prepaid Expenses: These are expenses paid in advance, such as insurance premiums or rent. They are considered assets because they represent future benefits for the company.

- Short-term Investments: These are investments in securities or other assets that are expected to be liquidated within a year.

Non-Current Assets: The Pillars of Long-Term Growth

Non-current assets, also known as long-term assets, are resources expected to benefit the business for more than one year. They represent the company's long-term investment in its operations and its capacity for future growth. These are often significant investments and contribute to the company's overall value over an extended period. These include:

- Property, Plant, and Equipment (PP&E): This category includes tangible assets used in the business's operations, such as land, buildings, machinery, vehicles, and furniture. These assets are subject to depreciation, reflecting their gradual wear and tear over time. The depreciation method used (straight-line, declining balance, etc.) impacts the reported value of these assets and the company's profitability.

- Intangible Assets: These are non-physical assets that provide economic benefits to the business. Examples include patents, copyrights, trademarks, goodwill, and brand recognition. These assets are often difficult to value accurately and are usually amortized over their useful lives. Goodwill, in particular, represents the premium paid for an acquisition over the fair market value of its identifiable net assets.

- Long-term Investments: These are investments in securities or other assets that are not expected to be liquidated within a year. This could include investments in other companies, bonds, or real estate held for investment purposes.

- Deferred Tax Assets: This arises when a company has overpaid taxes in the current period that can be used to offset future tax liabilities. It's a non-cash asset representing a future tax benefit.

Delving Deeper into Specific Asset Types

Let's explore some asset types in more detail to highlight their nuances and significance:

1. Goodwill: A crucial intangible asset, goodwill reflects the excess of the purchase price of a business over the fair value of its identifiable net assets. It essentially represents the value of the acquired company's reputation, brand loyalty, customer relationships, and other intangible factors contributing to its earning power. Goodwill is not amortized but is tested for impairment annually.

2. Intellectual Property (IP): This encompasses patents, trademarks, copyrights, and trade secrets. IP protection provides a competitive edge, allowing businesses to exploit their innovations and brand recognition, generating significant revenue streams. The valuation of IP is complex and often relies on future projected cash flows.

3. Inventory: Effective inventory management is crucial for profitability. Businesses need to balance sufficient stock levels to meet customer demand with minimizing storage costs and the risk of obsolescence. Different inventory valuation methods (FIFO, LIFO, weighted average cost) influence reported profits and tax liabilities.

4. Accounts Receivable: While representing potential future cash inflows, accounts receivable carry credit risk. Companies need robust credit policies and collection processes to minimize bad debts and ensure timely payment from customers. Aging analysis of receivables helps identify potential problems and track collection efforts.

The Impact of Asset Management on Business Success

Effective asset management is a cornerstone of successful business operations. It involves:

- Acquisition and Disposal: Careful evaluation of the need for new assets, optimal acquisition methods (leasing vs. purchasing), and strategic disposal of underutilized or obsolete assets.

- Maintenance and Upkeep: Regular maintenance of physical assets prolongs their useful lives, reduces repair costs, and minimizes operational disruptions.

- Risk Management: Identifying and mitigating potential risks associated with different asset types, including obsolescence, damage, theft, and credit risk.

- Valuation and Reporting: Accurate valuation of assets is critical for financial reporting, investment decisions, and tax purposes. Consistent and transparent reporting ensures accountability and provides stakeholders with a clear understanding of the company's financial position.

Conclusion: Assets – The Foundation of Business Wealth

Understanding the various types of business assets, their classification, and their impact on financial performance is paramount for any business owner or manager. Effective asset management not only contributes to financial stability but also fosters sustainable growth and competitive advantage. By strategically managing its assets, a business can optimize its operational efficiency, maximize its profitability, and build a strong foundation for long-term success. Regular review and analysis of asset performance should be a core component of any successful business strategy. The information contained herein is for informational purposes only and should not be considered professional financial advice. Consult with a qualified professional for personalized guidance.

Latest Posts

Latest Posts

-

Is Ice Cream A Homogeneous Mixture

May 09, 2025

-

A Food Chain Starts With A

May 09, 2025

-

Which Of The Following Statements About Chlorophyll Is Correct

May 09, 2025

-

Kinetic Energy Is Energy An Object Has Because Of Its

May 09, 2025

-

What Is The Least Common Multiple Of 20 And 40

May 09, 2025

Related Post

Thank you for visiting our website which covers about Resources Owned By A Business Are Referred To As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.