How To Write A Check For $11550

Juapaving

Apr 04, 2025 · 5 min read

Table of Contents

How to Write a Check for $11,550: A Comprehensive Guide

Writing a check for a significant amount like $11,550 requires precision and care. A single mistake can lead to delays, complications, and even financial loss. This comprehensive guide will walk you through the process step-by-step, ensuring you write a check correctly and confidently. We'll cover everything from understanding check components to best practices for security and record-keeping.

Understanding Your Check

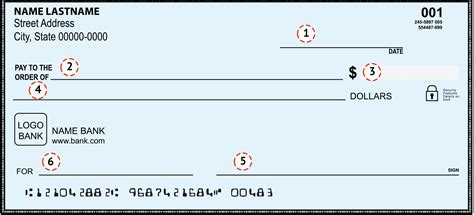

Before we dive into writing the check itself, let's familiarize ourselves with the key components of a standard check:

-

Your Name and Address (Payer): This is typically pre-printed at the top left corner of the check. This identifies you as the person or entity issuing the payment.

-

Check Number: Located in the upper right-hand corner, this unique number helps track your checks. Keep a record of all check numbers issued.

-

Date: Write the date you're issuing the check. This is crucial for tracking your finances and for reconciliation purposes.

-

Pay to the Order of (Payee): This line is where you write the name of the person or business receiving the payment. Write the name exactly as it appears on their official documentation, such as an invoice or contract. Avoid abbreviations or nicknames. If it's a company, use their full legal name.

-

Amount in Numeric Form: This is where you write the amount of the check numerically. For $11,550, write "11550". Place this amount close to the dollar sign to avoid alterations.

-

Amount in Words: This is the most critical step. Write the amount of the check in words, spelling it out completely. For $11,550, write "Eleven Thousand Five Hundred Fifty Dollars." Ensure no spaces are left between words and numbers to prevent fraud. This redundancy prevents errors or fraudulent alterations.

-

Memo Line: This optional line provides context for the payment. For example, you might write "Down payment for property purchase," or "Invoice #12345."

-

Your Signature: Sign the check in the signature line, which is located at the bottom right corner. This verifies the authenticity of the check and authorizes the payment.

Step-by-Step Guide to Writing a Check for $11,550

Now, let's walk through the process of writing your $11,550 check:

-

Gather Your Materials: You'll need your checkbook, pen (preferably a dark-ink pen to prevent alterations), and the recipient's information.

-

Date the Check: Write the current date in the designated space.

-

Fill in "Pay to the Order of": Write the full legal name of the payee. Double-check the spelling! If there's any doubt, contact the recipient to confirm the correct name.

-

Write the Numerical Amount: Write "11550" in the space provided. Align the number to the dollar sign.

-

Write the Amount in Words: This is the crucial step to prevent fraud. Write "Eleven Thousand Five Hundred Fifty Dollars." Start as close as possible to the left margin to leave no space for additions.

-

Complete the Memo Line (Optional): Write a brief description of the payment to help you track your finances later.

-

Sign the Check: Sign your check exactly as it's printed on the check. A differing signature may lead to rejection by the bank.

-

Review the Check: Before detaching the check, thoroughly review every detail – date, payee's name, numerical amount, written amount, memo, and your signature. Ensure everything is correct and accurate. Any mistakes may need correction. Incorrect checks can be returned and lead to complications.

Best Practices and Security Measures

Writing a check for a substantial amount like $11,550 necessitates heightened security measures:

-

Use a Check Writing Software (Optional): Consider using software specifically designed for writing checks to prevent mistakes. This is highly recommended for larger business transactions.

-

Use a Dark Ink Pen: Dark ink is less prone to alterations. Avoid using pencil or light-colored ink.

-

Avoid Abbreviations or Nicknames: Write the full legal name of the recipient to minimize ambiguity and prevent fraudulent alterations.

-

Fill Out All Spaces: Leave no blank space on the check, as this can create opportunities for alteration.

-

Use a Check Register: Keep a detailed check register for each check you write. This helps track your finances accurately and reconcile your bank statements.

-

Keep Checks Secure: Store your checkbook in a secure place away from unauthorized access.

Handling Potential Problems

Even with careful attention, issues can arise. Here's how to handle some common problems:

-

Mistakes in Writing the Check: If you make a mistake, do not try to correct it with whiteout or other cover-ups. Void the check and write a new one.

-

Lost or Stolen Check: Immediately report the loss or theft to your bank. Stop payment on the check to prevent fraudulent use.

-

Check Returns: If your check is returned (bounced), contact your bank and the recipient to resolve the issue. A bounced check reflects poorly on your financial standing.

Frequently Asked Questions (FAQs)

Q: What happens if I make a mistake writing a check for $11,550?

A: If you make a mistake, void the check and write a new one. Do not try to correct errors with whiteout or other cover-ups.

Q: Can I write "11,550" as the numerical amount?

A: While not strictly wrong, it's best to write "11550" without commas for clarity and to prevent alterations.

Q: What if I don't have enough money in my account to cover the $11,550 check?

A: The check will bounce, and you may incur fees from your bank and damage your credit score. Ensure you have sufficient funds in your account before writing a check.

Q: How can I protect myself against check fraud?

A: Use a dark ink pen, avoid leaving blank spaces, keep your checkbook secure, use a check register, and report any lost or stolen checks to your bank immediately.

Q: What should I do if my check is lost or stolen?

A: Contact your bank immediately to report the loss and request a stop payment on the check.

Q: Should I use a check or an alternative payment method for such a large sum?

A: While checks are still used, consider alternative methods such as wire transfer for large sums of money to enhance security and tracking.

This guide provides a comprehensive approach to writing a check for $11,550. By following these steps and employing the best practices outlined, you can ensure the process is accurate, secure, and trouble-free. Remember, accuracy and careful record-keeping are essential when dealing with significant financial transactions.

Latest Posts

Latest Posts

-

The Study Of Bones Is Called

Apr 10, 2025

-

20 Cm Is What In Inches

Apr 10, 2025

-

Choose The Best Definition Of Diastereomers

Apr 10, 2025

-

How Many Valence Electrons Are In Copper

Apr 10, 2025

-

Which Of The Following Is Not Fossil Fuel

Apr 10, 2025

Related Post

Thank you for visiting our website which covers about How To Write A Check For $11550 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.